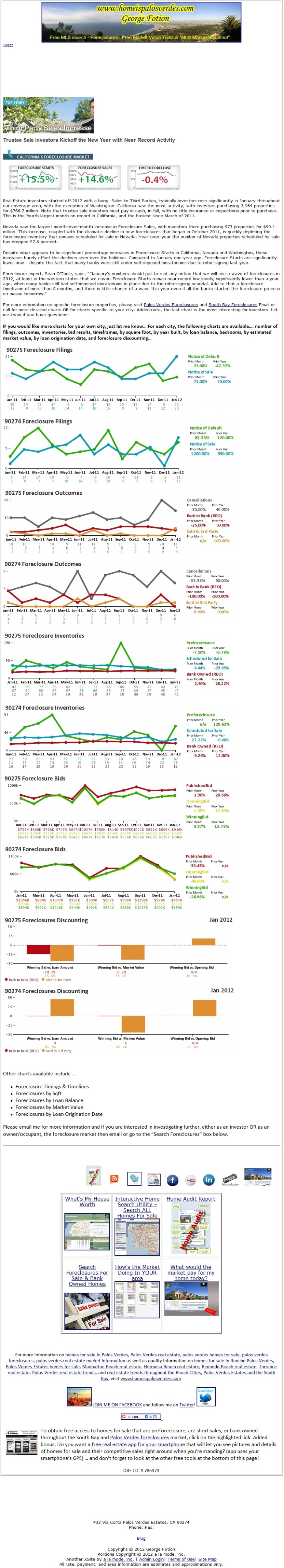

Palos Verdes Estates Foreclosure Report 4/12/2012It was reported today in RealtorMag.org that foreclosures are now down to 2007 levels. Of course what is happening nationally doesn’t necessarily apply to Palos Verdes or any local real estate market. Next to the old saying of “Location, Location, Location”, the next oldest saying is … “Real Estate Is All Local” Here’s the article … but please keep reading below to find out what’s happening in the 90274 zip code with Palos Verdes Foreclosures. And, if you would like a free resource that allows you to search for foreclosures, bank owned homes, auctions anywhere in California and of any property type (apartments, houses, condos, land, commercial property etc), go to the yellow button below.

For more information on foreclosure discounting and other statistics, go to my Palos Verdes Foreclosure website (link in the button below) |

||

|

||

Tag Archives: palos

Palos Verdes Real Estate Latest Trends

Is the Palos Verdes Homes Market & South Bay Real Estate Market Finally Turning Around?First and foremost, I’ve learned long ago NOT to be in the “crystal ball” business. So let me just report some facts

* to put this number in perspective, at the peak of our market in the 4th quarter of 2006, the ratio was over 100% This is just a small excerpt from one of the critical charts I keep that help me guide Palos Verdes home sellers to better price their homes so that they sell faster and for a higher net price.

|

|

|

Palos Verdes Estates Homes – Rent or Buy

As Rents Climb Higher, Owning a Palos Verdes Home Gains AppealI was reading an interesting article in the Wall Street Journal today about how home ownership is once again regaining popularity. You can read the full article by clicking on this picture below But it got me to thinking, “…Ok, so that’s what is happening on the national scale, what about here in town, is that translating to Palos Verdes homes?…” Look what I discovered: To view a full size image, just click the image below. I guess it’s time to buy a home in Palos Verdes Estates … |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Do folks correctly deduct for property taxes on Palos Verdes homes

Will the California Tax Man Come Looking for YOU?!Overlooked Property Tax Law as a source of RevenueDuring 2011, the California Franchise Tax Board (FTB) proposed a change to Schedule CA to require the information necessary to enforce an overlooked area of the real estate tax deduction. The real estate tax deduction applies to ad valorem taxes, the real estate tax amount based on the assessed value of a property. Taxes based on a direct levy or special assessment, such as Mello-Roos or various services provided to specific properties are generally not deductible. However, many taxpayers are not aware of this distinction and in practice most individuals or their tax preparers include the total property tax on Schedule CA. Until recently the FTB didn’t have the capability to determine whether the reported number included non-deductible taxes, but a computer system planned for 2012 will give the FTB that capability. The FTB had planned to enforce compliance stating this year by adding three lines to the 2011 state tax returns that would require property owners to show their parcel number, total property tax bill and the deductible amount. On November 1, 2011 the FTB announced the decision to delay the change to Schedule CA for a year and use 2012 to educate taxpayers and preparers on the rules. The board encourages voluntary compliance for 2011 tax returns and plans to enforce the rules on the 2012 Schedule CA. As part of the education effort, the FTB created a page on their website called Understanding the Real Estate Tax Deduction that explains the rules and provides an example tax bill with the ad valorem taxes and direct levies or special assessments broken down. For the 2011 tax year, some preparers are requiring their clients to bring in the county property tax statement before they will include the deduction in the Schedule CA. The FTB estimates that the change will bring in an additional $200 million of revenue per year and that voluntary compliance could bring in $20 million this year. |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Foreclosures | Free Search

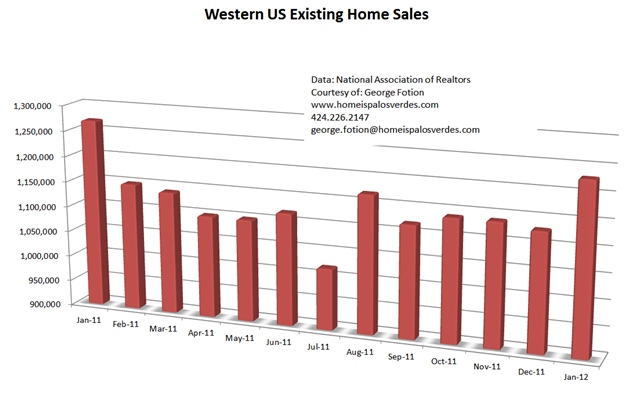

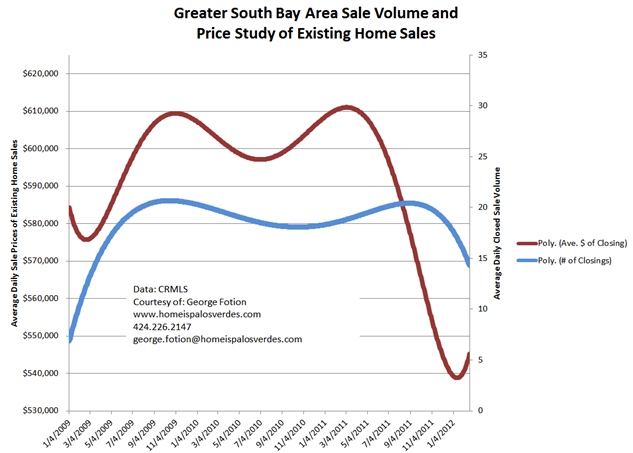

Palos Verdes Real Estate Trends vs Western US and the “cost” of rising sales

Existing Homes Sales Rise, but at a costExisting-home sales rose in January, marking three gains in the past four months, while inventories continued to improve, according to the National Association of Realtors®. Total existing-home sales1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 4.3 percent to a seasonally adjusted annual rate of 4.57 million in January from a downwardly revised 4.38 million-unit pace in December and are 0.7 percent above a spike to 4.54 million in January 2011. Lawrence Yun, NAR chief economist, said strong gains in contract activity in recent months show buyers are responding to very favorable market conditions. “The uptrend in home sales is in line with all of the underlying fundamentals – pent-up household formation, record-low mortgage interest rates, bargain home prices, sustained job creation and rising rents.” To read the full story, go here: http://www.realtor.org/press_room/news_releases/2012/02/ehs_jan What the story underplays however is that there was a cost to the rise in home sales and before you conclude I’m just a “Negative Nancy”, there may just be a silver lining to all of this. The cost is clear as evidenced by these charts. Home sales rose because prices have been dropping and as a result of lower prices, demand increased. Economists call this “elasticity of demand” and it appears that the real estate market is highly elastic as small changes in prices caused huge changes in demand. The National Association of Realtors reported that while prices are down in the “West” about 1.8%, home sales rose 8.8% You’ve heard me often say that real estate is all local and you would be right to say “so what” to what’s happening on a national or even regional basis. Keep reading below to see the charts on price and home sale volume for the South Bay. Meanwhile, thank you for reading your latest newsletter and when you come across someone looking to buy or sell real estate here in Palos Verdes or around the South Bay, take out your cell phone and text or call me! At Your Service, George Fotion

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Homes Absorption Trends

|

As always, no one can claim any clarity with a “crystal ball”. That being said, I found this article interesting and may give some clue as to what is happening nationally with real estate. Of course one of the oldest real estate sayings other than “Location, location, location” is that “All real estate is local” … meaning, it really doesn’t matter too much what is happening nationally, it’s all about what is happening on the local level. For example, real estate in the last 3 or 4 years has behaved much differently for Palos Verdes homes than it has for Riverside homes.

“The 2012 outlook is improving modestly from a disappointing 2011. Economic growth picked up in the fourth quarter of 2011 to 2.8 percent and is expected to come in at 2.3 percent for 2012, up from 1.6 percent growth for all of last year, according to Fannie Mae’s (FNMA/OTC) Economic & Strategic Research Group…” To read more, go here http://www.fanniemae.com/portal/about-us/media/financial-news/2012/5650.html For more information on Palos Verdes homes and Palos Verdes real estate, you’re welcome to visit my website at http://www.homeispalosverdes.com |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Estates homes in Lower Lunada Bay with Sport Court, Pool and large Flat Yard

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

I am committed to making sure you get the best customer service. Whether you choose to buy or sell real estate today, tomorrow, next week or 10 years from now, it doesn’t matter. You should feel confident and comfortable to count on me as your real estate resource for life. I promise you I will stay on the cutting edge of technology and service to make sure you have the information you need to be a more powerful real estate owner, buyer and or seller so that you get what you want, in the time you want it. Here is just one one of the many free services I offer. |

Palos Verdes Foreclosure Report for February 2012

Palos Verdes Foreclosure Report2-15-2012 Do you know what the latest trends are? Are foreclosures up or down? What are the banks doing? What are investors doing? How do you find foreclosure opportunities? Are bank owned homes a good deal anymore? If they’re not, where are the deals and how do you find them? Click on the image below to learn more.

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Foreclosure Auctions

|

Foreclosure auctions in Palos Verdes, South Torrance and the Beach Cities What are the opportunities for Investors, Home Buyers and Homeowners Upside Down in their Mortgages

What are the Advantages of a Short Sale to the Upside Down Homeowner?

HOWEVER the window for conducting a short sale without tax penalty is quickly drawing near! The benefits created from the 2007 Mortgage Forgiveness Debt Relief Act of 2007 EXPIRE on 12/31/2012. Homeowners upside down in their mortgages must NOT wait as if one waits too long into the 2012 year, the short sale may not close in time to satisfy the deadline!

What are the Advantages of a Short Sale to the Investor or Home Buyer? When I’m asked by my Buying Clients and Investors how best to take advantage of the “Foreclosure Market”, the preconception is that the Bank Owned homes are the properties wherein the greatest discounts can be achieved. This is not the case. There is so much scrutiny and oversight from government agencies and the banks’ investors that the banks selling an REO Property are just as motivated as any other “Mr. and Mrs. Homeowner” to extract the highest price possible. In fact, when I’m calling bank REO Asset managers, I’m getting the standard response (from all the banks), “…sorry, we can’t consider any offers until the property’s been on the MLS for at least 5 days…” The banks KNOW that the best chance to get the highest price is to have maximum exposure through the multiple listing service. So that leaves the Home Buyer or Investor two choices … either go to the auction and try to buy (you will need cash, you won’t be able to inspect the property and you may not get clear title) OR use the strategy that I’ve developed to negotiate with the Homeowner. What we’re doing is creating WIN – WIN situations for all parties and if you would like to know more, DO NOT REPLY to this email, rather send me an email to george.fotion@homeispalosverdes.com. So whether you are a homeowner upside down in your mortgage, or you’re an investor or buyer or know someone in either category that could really benefit from this, send me an email and we will set an appointment to discuss further. By the way, the map above shows just the Single Family Residences. There are a few, just a handful, but a few Multi-Family units (apartments, duplexes, triplexes and quads) As always, thank you for reading your newsletter! |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||