Palos Verdes Real Estate Transaction Report

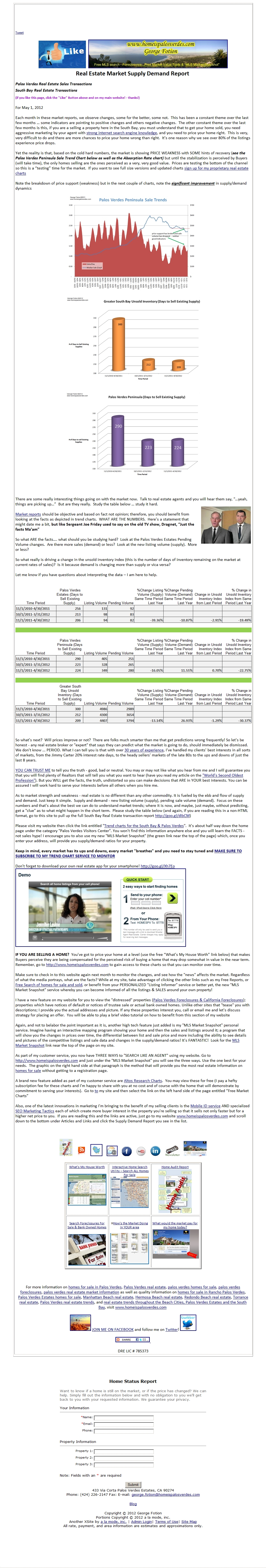

Supply & Demand Study for the last 6 months for the South Bay and the Palos Verdes PeninsulaThe biggest change is in supply. Keep in mind, real estate, as in any other commodity, has it’s price determined by the balance or imbalance in supply and demand. To read the full report and see the changes taking place for the Palos Verdes homes market and the South Bay real estate market, go to the Palos Verdes Homes Supply & Demand Report.

|

||

|

||

Tag Archives: foreclosures

Palos Verdes Short Sale Homes Information

|

Palos Verdes Short Sale Major Update Even if a short sale doesn’t apply to you, chances are you know someone for whom a short sale might be a good idea. And if you do, there are two very critical issues that such a person must know about to help with their Palos Verdes short sale or South Bay short sale. First of all the the Mortgage Debt Relief Act expires on December 31, 2012. Prior to the passage of this Act, debt relief resulting from a foreclosure or a short sale was considered income by the IRS. For example, let’s say the loan on the house was $1,000,000 but the house was sold as a short sale for $850,000. That difference of $150,000 was a taxable event to the homeowner! However after passage of the Act, both the State of California and the Feds caused this “gift” to not be a taxable event. Unless it is extended, this benefit expires very, very soon so the very real benefits to doing a short sale, will disappear! So if you are considering a short sale or if you know someone that should, time is of the essence! Now the second piece of information is really exciting! Breaking news: June 1, 2012, the 3 major credit reporting agencies have announced they will change the impact of short sales on a borrower’s credit (assuming they missed no payments and weren’t late) to a ‘neutral’ . Meaning little to no negative credit ramifications. This is HUGE. Quoting from the Harris Real Estate Training Center: Q. Can I do a short sale even if I am current on my payments and can afford the payments? Breaking news: June 1, 2012, the 3 major credit reporting agencies have announced they will change the impact of short sales on a borrower’s credit (assuming they missed no payments and weren’t late) to a ‘neutral’ . Meaning little to no negative credit ramifications. Translated: If you didn’t miss any payments prior to the short sale you won’t have a credit hit. Even better, the standards to obtain a mortgage following a short sale have changed dramatically. If you didn’t miss ANY payments prior to the short sale it is possible to get another mortgage immediately. Yes, you read that correctly. Short Sale today…buy today. Generally speaking, if you did miss payments prior to your short sale you will have to wait as little as 18-24 months before securing another mortgage. So, bottom line, the time to act is now. When you have questions, give me a call and let’s talk about this AND if you are interested in understanding the benefits as an INVESTOR in the short sale arena, let’s set an appointment to discuss this. You can use the article in the yellow button below to start thinking about this. For more general real estate information, please visit http://www.homeispalosverdes.com To view listings of distressed properties in Palos Verdes, please scroll down to below my website logo and click the image of the map |

||

|

||

Palos Verdes Estates Home Market Trends

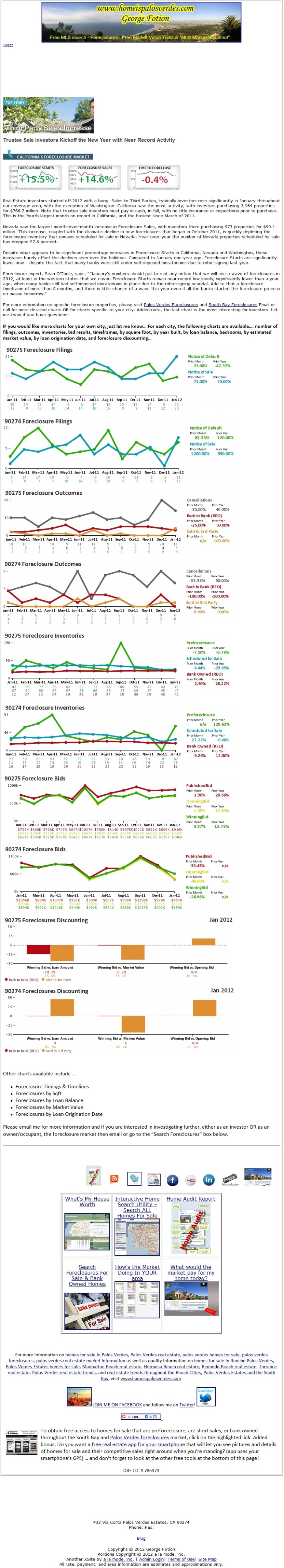

Palos Verdes Foreclosures – Down or Up?

Palos Verdes Estates Foreclosure Report 4/12/2012It was reported today in RealtorMag.org that foreclosures are now down to 2007 levels. Of course what is happening nationally doesn’t necessarily apply to Palos Verdes or any local real estate market. Next to the old saying of “Location, Location, Location”, the next oldest saying is … “Real Estate Is All Local” Here’s the article … but please keep reading below to find out what’s happening in the 90274 zip code with Palos Verdes Foreclosures. And, if you would like a free resource that allows you to search for foreclosures, bank owned homes, auctions anywhere in California and of any property type (apartments, houses, condos, land, commercial property etc), go to the yellow button below.

For more information on foreclosure discounting and other statistics, go to my Palos Verdes Foreclosure website (link in the button below) |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verde Real Estate Transaction Report

So how long IS it taking to sell a Palos Verdes home?Most agents are trained to give you what the “average days on market” are but that really is a misleading statistic. What you REALLY need to know as a seller is how many days of unsold inventory are there on the market? Ask the real estate agent you’re planning to interview for the very serious job of selling your home this question, “Assuming no other listings came on the market, how many days would it take the market to absorb existing supplies?” See if their eyes glaze over … if they do, find another agent … because not only do you want to get an understanding of what you’re up against when planning your next transition from your current home in Palos Verdes, but you also want to know the statistical probability, given what the current absorption number is, for selling in the next 30 days, 60 days, 90 days etc. For example, did you know that right now, there are 224 days of unsold inventory for Palos Verdes real estate? That’s a lot of days, but better than the 293 days for the same time period last year. Given this 224 days of unsold inventory then, here are your chances of selling. These are calculations based on a standard deviation analysis of the absorption rate What are my chances of selling in…

So now that you know the realities of the market and if you’re a seller and you absolutely have to have, not a 19.30% chance of selling in 90 days but at least an 80% chance of selling … what do you think has to happen? Would love to read your comments! To view the latest suppy/demand trends please go here: Palos Verdes Real Estate Transaction Report

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Foreclosures | Free Search

Palos Verdes Foreclosure Report for February 2012

Palos Verdes Foreclosure Report2-15-2012 Do you know what the latest trends are? Are foreclosures up or down? What are the banks doing? What are investors doing? How do you find foreclosure opportunities? Are bank owned homes a good deal anymore? If they’re not, where are the deals and how do you find them? Click on the image below to learn more.

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Foreclosure Auctions

|

Foreclosure auctions in Palos Verdes, South Torrance and the Beach Cities What are the opportunities for Investors, Home Buyers and Homeowners Upside Down in their Mortgages

What are the Advantages of a Short Sale to the Upside Down Homeowner?

HOWEVER the window for conducting a short sale without tax penalty is quickly drawing near! The benefits created from the 2007 Mortgage Forgiveness Debt Relief Act of 2007 EXPIRE on 12/31/2012. Homeowners upside down in their mortgages must NOT wait as if one waits too long into the 2012 year, the short sale may not close in time to satisfy the deadline!

What are the Advantages of a Short Sale to the Investor or Home Buyer? When I’m asked by my Buying Clients and Investors how best to take advantage of the “Foreclosure Market”, the preconception is that the Bank Owned homes are the properties wherein the greatest discounts can be achieved. This is not the case. There is so much scrutiny and oversight from government agencies and the banks’ investors that the banks selling an REO Property are just as motivated as any other “Mr. and Mrs. Homeowner” to extract the highest price possible. In fact, when I’m calling bank REO Asset managers, I’m getting the standard response (from all the banks), “…sorry, we can’t consider any offers until the property’s been on the MLS for at least 5 days…” The banks KNOW that the best chance to get the highest price is to have maximum exposure through the multiple listing service. So that leaves the Home Buyer or Investor two choices … either go to the auction and try to buy (you will need cash, you won’t be able to inspect the property and you may not get clear title) OR use the strategy that I’ve developed to negotiate with the Homeowner. What we’re doing is creating WIN – WIN situations for all parties and if you would like to know more, DO NOT REPLY to this email, rather send me an email to george.fotion@homeispalosverdes.com. So whether you are a homeowner upside down in your mortgage, or you’re an investor or buyer or know someone in either category that could really benefit from this, send me an email and we will set an appointment to discuss further. By the way, the map above shows just the Single Family Residences. There are a few, just a handful, but a few Multi-Family units (apartments, duplexes, triplexes and quads) As always, thank you for reading your newsletter! |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Rancho Palos Verdes CA Bank Owned Homes

Rancho Palos Verdes CA Bank Owned Homeas of 1/25/2012

4 Bedrooms This property is NOT listed for sale For more details and availability, respond to this ad Search for other Palos Verdes homes for sale and gets lots of information on Palos Verdes real estate without having to log in or provide your information. To search for foreclosures in Palos Verdes go to this link DRE #785373 |

How to search for Palos Verdes Foreclosures and Auctions

How do you find Palos Verdes foreclosures not listed for sale?Go to this link to use the site described below And to update your searches for Palos Verdes foreclosures go here.

For more information on homes for sale in Palos Verdes, Palos Verdes real estate, palos verdes homes for sale, palos verdes foreclosures, palos verdes real estate market information as well as quality information on homes for sale in Rancho Palos Verdes, Palos Verdes Estates homes for sale, Manhattan Beach real estate, Hermosa Beach real estate, Redondo Beach real estate, Torrance real estate, Palos Verdes real estate trends, and real estate trends throughout the Beach Cities, Palos Verdes Estates and the South Bay, visit www.homeispalosverdes.com

DRE LIC # 785373

|