Fishing around the Palos Verdes Area

Are you into fishing? Here’s something you can do in the Palos Verdes area after you’ve bought your Palos Verdes home. “A cold water cycle might be contributing to the abundance of rockfish along the Southern California coast, anglers said after some large catches over the weekend. ‘It’s rare to catch so many reds (vermilion) in such shallow water along the coast,’ said Don Ashley from Pierpoint Landing.” This is a great article written by Philip Friedman; just go here on Palos Verdes Patch to read more If you have any questions about what to do around Palos Verdes, Palos Verdes real estate and homes for sale in Palos Verdes, just visit the links below or give me call. |

||

|

||

Tag Archives: palos verdes ca homes for sale

California Real Estate Transaction Report

The Big Picture for California Real EstateCalifornia pending home sales climb from previous month and year, post higher for sixth straight month, C.A.R. reports Pending home sales in California rose in October and were up from the previous year for the sixth consecutive month. Additionally, distressed home sales rose in October from both the previous month and year, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) reported today. Pending home sales:

“October’s increase in pending sales is encouraging, especially the six straight months of year-over-year increases,” said C.A.R. President LeFrancis Arnold. “Despite all the challenges the housing market has faced this year, California home sales continue to perform modestly well and should be on pace to match or better last year’s level.” Distressed housing market data:

|

||

|

||

Are you a landlord and having a hard time renting your Palos Verdes Real Estate

|

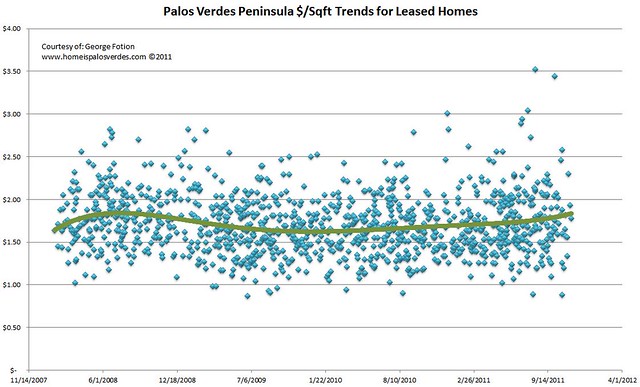

How’s the home rental market in Palos Verdes CA? One of my clients asked me today about the rental market. He’s having a hard time finding tenants and keeping tenants and wanted my advice on how to lower his vacancy costs and get better tenants. My advise for him is a bit counter intuitive but it really does make sense … Here’s an excerpt of the email I sent him. Follow along and you will “get it”… But for the SFR Market … values are stable and in fact there is some strength being shown in pricing (see chart below or attached). Also given the number of leased homes in the last 12 months and the number of active properties on the market for lease now, there are 56 days of unleased inventory on the market. In other words, at the pace it took to lease a home brought to market in the last year, it would take 56 days to deplete the current level of available homes assuming no other properties were listed.

This tells us that when calculating expenses, one should factor in a vacancy rate of at LEAST 2 months worth of rent.

THIS IS MOST IMPORTANT: The median leased price of a home on the Peninsula in the last 12 months was $3,800/mo. So if you’re figuring now on 2 months worth of rent for expenses on a vacancy factor … that’s $7,600. So let’s say “fair market value” for your property was $3800/mo. Wouldn’t it be more wise to LIST the property at $3650/mo ($150/mo LESS than fair market) in order to get it rented FASTER and gather a greater number of QUALITY applicants from which you can choose the best? So you lose $150/mo. X12 months, that’s $1800. But if you could rent the property in 30 days or less because of the lower rent instead of the 60 days calculated by the absorption rate, YOU ARE STILL AHEAD by $2000 (3800-1800 = $2,000_

This is the mistake most landlords make. They ask TOO MUCH or they ask what they think is fair and it takes TOO LONG to find a tenant and the one that applies is often not the best. Instead, ask less and get more! With a lower than market rent, you will rent it faster, get more applicants, and have the luxury of picking a good one.

For more information on Palos Verdes Real Estate, go to http://www.homeispalosverdes.com |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Rancho Palos Verdes CA Bank Owned Homes

|

Rancho Palos Verdes Bank Owned Homes It’s been about 30 days since a bank took back a home here in Rancho Palos Verdes; however, title records show that 6842 Crest Road was taken back by bank today (11/21/2011) for $1,200,000. The home has an ocean and golf course view and features 4bedrooms, 3bathrooms, a lot of nearly 15000sqft and living area of a bit under 3000sqft (information is taken from public tax records) You can find other Palos Verdes bank owned homes as well as information on Palos Verdes real estate and Palos Verdes homes for sale by navigating to the sites shown below. Meanwhile, here’s an aerial shot of the property

To learn more about my Palos Verdes foreclosure information service play this video |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes CA Foreclosure Market Profile

|

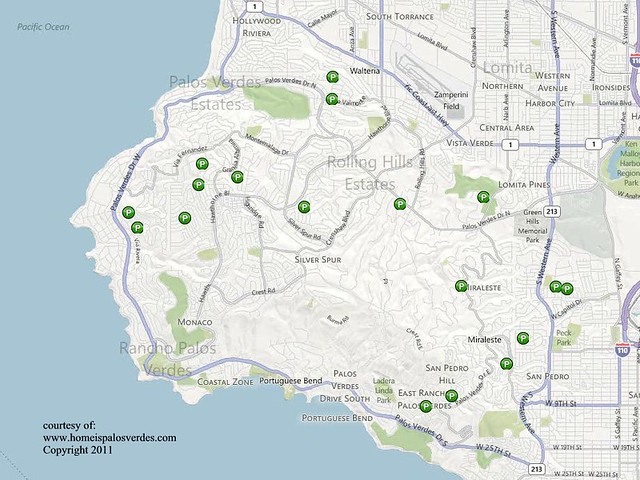

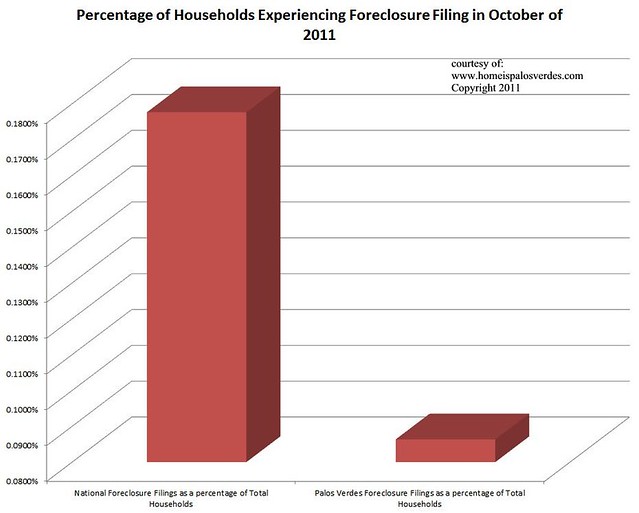

The Palos Verdes Foreclosure Market There’s been so much talk in the last couple of years about foreclosures I thought everyone would be interested in knowing what exactly the bank owned market looks like for Palos Verdes real estate. Jed Smith, the Managing Director of Quantitative Research for the National Association of Realtors, reported on November 1st of this year that, “…The press has been publicizing the potential for continued declines in the real estate markets. However, approximately three years’ worth of data indicates that distressed sales have leveled off in the 30 to 35 percent range in the real estate markets. This suggests that financial institutions are feeding the properties into the market on a relatively constant basis, and given current economic conditions no great surge of shadow inventories has appeared. The good news is that the markets are clearing the properties and that additional price pressures from a surge of shadow inventories does not appear likely. The bad news is that the problem appears likely to be with us for the next two to three years, suggesting that future price appreciation may be slow…” As you can see by the map I attached, there are quite a few Palos Verdes bank owned homes but as a percentage of the total number of households here on the Palos Verdes Peninsula, it doesn’t come close to the same percentage as exists nationally, so our “shadow inventory” picture is not nearly as dire.

There is a corollary to the age old #1 rule of real estate “Location, Location, Location”, and that is “All Real Estate is Local”. Meaning, what is happening nationally, may not be true in your local market. For example, a leading foreclosure research company reported this month that, “…one in every 563 U.S. housing units experienced a foreclosure filing during the month…” This was reported for the month of October. It was reported in that article that as a percentage, that represented about 0.1776% for the national market. But for Palos Verdes real estate, the percentage is a mere a 0.0864%, or in other words, nationally, the foreclosure activity is more than double what it is we find for Palos Verdes homes. The above map shows those homes that had filings in the month of October, 2011 and below you can see how the Palos Verdes real estate foreclosure market compares to the national market

Sometimes it’s important to put things in perspective. |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Update on Conforming Loan Limit and affect on Palos Verdes Real Estate

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes CA Real Estate would benefit from possible Conforming Loan Limit increase

|

Congress may restore home-loan limit to $729,750 “Congress will decide this week whether to reinstate the limit on government-backed home loans in high-cost areas to $729,750. The so-called conforming-loan limit dropped to $625,500 on October 1. Although the odds of passage have fallen in the past week, FBR Capital Markets analyst Edward Mills says they are still better than 50-50” Read more of Kathleen Pender’s article in the San Francisco Chronicle: http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2011/11/14/BUIQ1LV1P3.DTL#ixzz1e1NHxHzL

This will really help Palos Verdes real estate as the median price of homes in Palos Verdes is $1,125,000

For the median priced home for sale in Palos Verdes of $1,125,000, this means that without the loan limit being increased, you would have to come up with additional $104,250 to buy Palos Verdes homes for sale. With most folks wanting to do some remodeling on the home they just bought, that $104,250 would come in handy! So what to do? Write, call or email your Congressman. For Palos Verdes, that would be Dana Rohrabacher Washington, D.C. Office |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

72 Narcissa, Rancho Palos Verdes, CA 90275 – Virtual Tour Website for Portuguese Bend Homes For Sale

|

Palos Verdes Foreclosure Report

|

Palos Verdes Foreclosure Report

This and more is available from my monthly Palos Verdes Foreclosure Report

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Real Estate Transaction Information and the 2012 California Real Estate Forecast

Gradual Recovery for Housing and the Economy Expected in 2012Although the housing market struggled to maintain an even footing in 2011, gradual improvement is expected in 2012 and beyond, according to projections at a residential forum here at the 2011 Realtors® Conference & Expo. You can view the entire presentation by going here: 2012-california-real-estate-forecast The article will take a long time to load as it’s a 23mb Power Point presentation and will work better if you choose to download and save instead of view online when prompted by your browser. At the end of this article you will see a link to get Real Estate Transaction Trend information for Palos Verdes and the South Bay such as this chart that shows the balance between supply (new listing volume) and demand (pending sale volume) Lawrence Yun*, chief economist of the National Association of Realtors®, said home sales should be stronger. “Tight mortgage credit conditions have been holding back home buyers all year, and consumer confidence has been shaky recently,” he said. “Nonetheless, there is a sizeable pent-up demand based on population growth, employment levels and a doubling-up phenomenon that can’t continue indefinitely. This demand could quickly stimulate the market when conditions improve.” Yun projects growth in Gross Domestic Product to be 1.8 percent this year, then rising moderately at a rate of 2.2 percent in 2012. With job growth of 1.7 to 2.2 million next year, the unemployment rate is expected to decline to 8.7 percent by the second half of 2012. Mortgage interest rates should gradually rise from recent record lows and reach 4.5 percent by the middle of 2012. “Housing affordability conditions, based on the relationship between median home prices, mortgage interest rates, and median family income, have been at a record high this year,” Yun said. “Very favorable affordability conditions will dominate next year as well, which will probably be the second best year on record dating back to 1970. Our hope is that credit restrictions will ease and allow more home buyers to take advantage of current opportunities.” Existing-home sales are forecast to edge up about 1 percent this year, and then rise another 4 to 5 percent in 2012. Based on NAR’s current projection model, existing-home sales would total 4.96 million in 2011. NAR presently is benchmarking* existing-home sales, and downward revisions are expected for totals in recent years, although there will be little change to previously reported comparisons based on percentage change. There will be will be no change to median prices or month’s supply of inventory. Publication of the improved measurement methodology is expected in the near future. New-home sales are expected to be a record low 302,000 this year, rising to 372,000 in 2012. Housing starts are forecast to rise to 630,000 next year from 583,000 in 2011. “Although a double-digit growth in new-home sales and housing starts sounds encouraging, the projections remain historically soft relative to long-term underlying demand,” Yun explained. With falling inventory, the median home price should rise in 2012. “Home prices have yet to show a definitive stabilization pattern in most areas. Still, given an over-correction in prices, there likely will be moderate appreciation in 2012,” Yun said. “Once home prices turn positive on a sustained basis, consumer confidence will rise and help the broader economy to improve,” Yun added. “If we could maintain sound and reasonable mortgage underwriting standards, the market would be able to avoid a future big boom and bust cycle, but mortgage standards remain overly stringent.” Also speaking was Richard Peach, Senior Vice President at the Federal Reserve Board of New York, who said the economy is under-performing. “Nearly two-and-a-half years since the end of ‘the great recession,’ the economy continues to operate well below its potential,” he said. “Among the significant structural impediments are the legacy of the housing boom and bust, and fiscal contrition at the state and local level.” Peach said the current business cycle remains 7 percent below its peak and is longer than other recession cycles since 1953. He added the employment to population ratio is historically low, and there’s been a shift in the distribution of income with corporate profits up strongly while employment compensation is down. Peach believes there is a sizeable level of shadow inventory that will result in rising foreclosures. “My idea is to allocate certificates to 2.5 million service members who served in Afghanistan and Iraq that could be used as a downpayment on a foreclosed home in the Fannie or Freddie portfolio,” he said. This would help to absorb the inventory and stabilize the housing market. The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1.1 million members involved in all aspects of the residential and commercial real estate industries. # # # About the Chief EconomistLawrence Yun

Dr. Yun has been with the REALTORS® market research department since the year 2000. Prior to that, he worked as an economic consultant to the U.S. Department of Veterans Affairs and the U.S. Department of Education. From 1995 to 1998, while a research associate at the University of Maryland, he was based in the former Soviet Union where he developed economics programs at several universities to help in the transition from communism to a market based economy. Dr. Yun received his undergraduate degree from Purdue University and earned his Ph.D. from the University of Maryland at College Park. All major statistical data series go through periodic reviews and revisions to ensure that sampling and methodology keep up with changes in the market, such as population changes in sampled areas, to ensure accuracy. NAR began its normal process for benchmarking sales at the beginning of this year in consultation with government agencies, outside housing economists and academic experts. |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Lawrence Yun is Chief Economist and Senior Vice President of Research for the National Association of REALTORS® Research department . He directs research activity for the association and regularly provides commentary on real estate market trends for its 1 million REALTOR® members. Dr. Yun creates NAR’s real estate market forecasts and participates in many economic forecasting panels, including Blue Chip and the Harvard University Industrial Economist Council. He appears regularly on financial news outlets and is a frequent speaker at real estate conferences throughout the United States. In 2008, USA Today listed him among the top 10 economic forecasters in the country.

Lawrence Yun is Chief Economist and Senior Vice President of Research for the National Association of REALTORS® Research department . He directs research activity for the association and regularly provides commentary on real estate market trends for its 1 million REALTOR® members. Dr. Yun creates NAR’s real estate market forecasts and participates in many economic forecasting panels, including Blue Chip and the Harvard University Industrial Economist Council. He appears regularly on financial news outlets and is a frequent speaker at real estate conferences throughout the United States. In 2008, USA Today listed him among the top 10 economic forecasters in the country.