Tag Archives: palos verdes bank owned homes

Palos Verdes Homes Absorption Trends

|

As always, no one can claim any clarity with a “crystal ball”. That being said, I found this article interesting and may give some clue as to what is happening nationally with real estate. Of course one of the oldest real estate sayings other than “Location, location, location” is that “All real estate is local” … meaning, it really doesn’t matter too much what is happening nationally, it’s all about what is happening on the local level. For example, real estate in the last 3 or 4 years has behaved much differently for Palos Verdes homes than it has for Riverside homes.

“The 2012 outlook is improving modestly from a disappointing 2011. Economic growth picked up in the fourth quarter of 2011 to 2.8 percent and is expected to come in at 2.3 percent for 2012, up from 1.6 percent growth for all of last year, according to Fannie Mae’s (FNMA/OTC) Economic & Strategic Research Group…” To read more, go here http://www.fanniemae.com/portal/about-us/media/financial-news/2012/5650.html For more information on Palos Verdes homes and Palos Verdes real estate, you’re welcome to visit my website at http://www.homeispalosverdes.com |

||

|

||

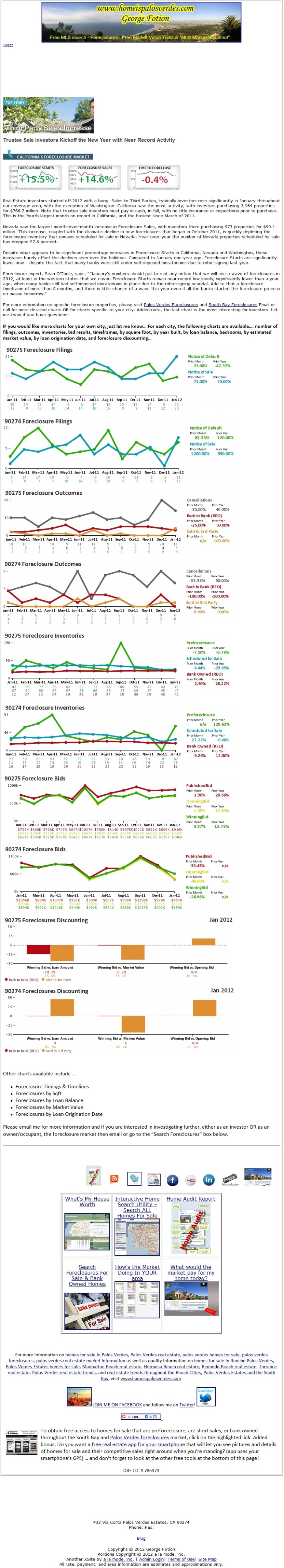

Palos Verdes Foreclosure Report for February 2012

Palos Verdes Foreclosure Report2-15-2012 Do you know what the latest trends are? Are foreclosures up or down? What are the banks doing? What are investors doing? How do you find foreclosure opportunities? Are bank owned homes a good deal anymore? If they’re not, where are the deals and how do you find them? Click on the image below to learn more.

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Rancho Palos Verdes Bank Owned Homes

|

ARE YOU A REAL ESTATE AGENT USING THE INFORMATION ON THIS SITE FOR YOUR CUSTOMERS? HERE’S A CONCEPT – GO AND INVEST YOUR OWN MONEY AND TIME TO PROVIDE THIS SERVICE INSTEAD OF “STEALING” MY WORK PRODUCT. WHAT A CONCEPT! Do you want REAL TIME access to Palos Verdes foreclosures (both listed and not listed?) …. Sign up here Scroll down to view the current Palos Verdes bank owned homes

Scroll down to bottom to use other free services & utilities

Free Real Estate Utilities and Tools for You to Use Make http://www.homeispalosverdes.com YOUR real estate resource

For more information on homes for sale in Palos Verdes, Palos Verdes real estate, palos verdes homes for sale, palos verdes foreclosures, palos verdes real estate market information as well as quality information on homes for sale in Rancho Palos Verdes, Palos Verdes Estates homes for sale, Manhattan Beach real estate, Hermosa Beach real estate, Redondo Beach real estate, Torrance real estate, Palos Verdes real estate trends, and real estate trends throughout the Beach Cities, Palos Verdes Estates and the South Bay, visit www.homeispalosverdes.com

DRE LIC # 785373 Palos Verdes Bank Owned Homes updated in real time based. You can be assured that when a foreclosure auction takes on a Palos Verdes home, and the property reverts back to the bank, I will update this site that very day! |

Palos Verdes Foreclosure Auctions

|

Foreclosure auctions in Palos Verdes, South Torrance and the Beach Cities What are the opportunities for Investors, Home Buyers and Homeowners Upside Down in their Mortgages

What are the Advantages of a Short Sale to the Upside Down Homeowner?

HOWEVER the window for conducting a short sale without tax penalty is quickly drawing near! The benefits created from the 2007 Mortgage Forgiveness Debt Relief Act of 2007 EXPIRE on 12/31/2012. Homeowners upside down in their mortgages must NOT wait as if one waits too long into the 2012 year, the short sale may not close in time to satisfy the deadline!

What are the Advantages of a Short Sale to the Investor or Home Buyer? When I’m asked by my Buying Clients and Investors how best to take advantage of the “Foreclosure Market”, the preconception is that the Bank Owned homes are the properties wherein the greatest discounts can be achieved. This is not the case. There is so much scrutiny and oversight from government agencies and the banks’ investors that the banks selling an REO Property are just as motivated as any other “Mr. and Mrs. Homeowner” to extract the highest price possible. In fact, when I’m calling bank REO Asset managers, I’m getting the standard response (from all the banks), “…sorry, we can’t consider any offers until the property’s been on the MLS for at least 5 days…” The banks KNOW that the best chance to get the highest price is to have maximum exposure through the multiple listing service. So that leaves the Home Buyer or Investor two choices … either go to the auction and try to buy (you will need cash, you won’t be able to inspect the property and you may not get clear title) OR use the strategy that I’ve developed to negotiate with the Homeowner. What we’re doing is creating WIN – WIN situations for all parties and if you would like to know more, DO NOT REPLY to this email, rather send me an email to george.fotion@homeispalosverdes.com. So whether you are a homeowner upside down in your mortgage, or you’re an investor or buyer or know someone in either category that could really benefit from this, send me an email and we will set an appointment to discuss further. By the way, the map above shows just the Single Family Residences. There are a few, just a handful, but a few Multi-Family units (apartments, duplexes, triplexes and quads) As always, thank you for reading your newsletter! |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Rancho Palos Verdes CA Bank Owned Homes

Rancho Palos Verdes CA Bank Owned Homeas of 1/25/2012

4 Bedrooms This property is NOT listed for sale For more details and availability, respond to this ad Search for other Palos Verdes homes for sale and gets lots of information on Palos Verdes real estate without having to log in or provide your information. To search for foreclosures in Palos Verdes go to this link DRE #785373 |

How to search for Palos Verdes Foreclosures and Auctions

How do you find Palos Verdes foreclosures not listed for sale?Go to this link to use the site described below And to update your searches for Palos Verdes foreclosures go here.

For more information on homes for sale in Palos Verdes, Palos Verdes real estate, palos verdes homes for sale, palos verdes foreclosures, palos verdes real estate market information as well as quality information on homes for sale in Rancho Palos Verdes, Palos Verdes Estates homes for sale, Manhattan Beach real estate, Hermosa Beach real estate, Redondo Beach real estate, Torrance real estate, Palos Verdes real estate trends, and real estate trends throughout the Beach Cities, Palos Verdes Estates and the South Bay, visit www.homeispalosverdes.com

DRE LIC # 785373

|

Sell Palos Verdes Estates real estate for more money

Selling a home in Palos VerdesIt’s all about E X P O S U R E !Of the many venues available to expose and market real estate in Palos Verdes, Realtor.com is one of the best. It’s no wonder that my investment in marketing my sellers homes pays off with faster sales and higher prices for my sellers all due to creating more buyers competing for the property.

Of the nearly 6,000 agents in the South Bay area of Southern California, there are only EIGHT maximum agents that can expose your Palos Verdes home for sale on Realtor.com as a FEATURED LISTING. This added exposure is essential to getting the highest price in the shortest period of time and with the least amount of inconvenience for my sellers. When you’re ready to sell your Palos Verdes real estate, how can you possibly afford not having this benefit. |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Foreclosures and Bank Owned Home News

Palos Verdes ForeclosuresWere you aware that time is running out for distressed homeowners who are upside down in their homes?The Federal Mortgage Forgiveness Debt Relief Act of 2007 provided enormous benefits for distressed owners of Palos Verdes homes and Palos Verdes real estate. These benefits EXPIRE on December 31, 2012. Trust me on this … if you’re in a position where you need to capture the benefits of a short sale, you do NOT want to wait to the last minute. It could cost you tens of thousands of dollars with added tax liability to the federal government and state government. Before this Act was passed, when a home goes to foreclosure or short sale, the loss to the bank (or debt forgiveness) is considered income to the homeowner. The bank will report that income to the Internal Revenue Service on a 1099 form, and a taxpayer in the 28 percent tax bracket could owe as much as $28,000 on a $100,000 loss to the bank. For a homeowner, it’s like salt in the wound – not only did they lose their home to foreclosure, but they now the IRS is calling? Lawmakers enacted the Debt Relief Act to shield distressed homeowners from such a financially devastating event. The Debt Relief Act covers: TIMEFRAME: Up to $2 million of debt ($1 million if married filing separately) forgiven between Jan. 1, 2007, and Dec. 31, 2012. PRINCIPAL RESIDENCE: The forgiven debt must be on a qualified principal residence, generally considered to be a home in which you have lived full time two out of the last five years. Check with your tax preparer to determine if your home falls into this category. Debt forgiven on a second home, income property, credit cards, car loans, etc. do not qualify for the tax forgiveness, according to the legislation. PURCHASE MONEY: The debt must have been used to “buy, build or substantially improve” your principal residence and be secured by that property. If you refinanced the home and took cash out to remodel the home, it may be covered. Cash out to pay other bills or make purchases would not qualify, however. Though some property owners may not qualify for the protections of the Debt Relief Act, there are alternatives. INSOLVENCY: If a consumer’s liabilities exceed their assets, they may fall under the IRS definition of “insolvency,” and some or all of their canceled debt may not be taxable. Your tax preparer can help you determine if you are insolvent and help you complete a Form 982 as part of your tax return. BANKRUPTCY: Debts discharged through bankruptcy are not taxable income. DEFICIENCY BALANCE: Tax liability on a discharged debt differs from a deficiency. In California, the owner of a home lost through foreclosure or sold in a short sale often is not liable for the balance owed. Loan modifications and short sales can take several months or longer. Homeowners facing difficulties should not wait until the last moment to take action. The rush to complete a short sale or loan mod at the end of 2012 will keep many from taking advantage of the federal protections. If you know someone that needs to understand the benefits of short selling their home OR you want to know about what advantages there are as an investor to buying a short sale, contact me today! |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Knowing what the Fed is thinking helps when buying or selling Palos Verdes real estate

Want to know a Secret about what the Federal Reserve is thinking?Did you know that on January 25th the Fed will begin to publish their predictions about interest rates? From the “Daily Real Estate News” at Realtor.org, “Beginning Jan. 25, the Federal Reserve will start to publish a forecast four times a year that includes predictions about the direction of short-term interest rates, The New York Times reports. The report will include a summary of how long the Fed expects to keep short-term rates at current levels.” You can read the rest of the story here So now you have a new tool to help you decide when you’re buying or selling Palos Verdes real estate.

And now that interest rates are so low, what a great time to own a dream home in the Lower Lunada Bay area of Palos Verdes Estates… This is a piece of Palos Verdes real estate to be cherished a lifetime! |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

4 bedrooms

4 bedrooms

4 bedrooms

4 bedrooms

2 bedrooms

2 bedrooms

8 bedrooms

8 bedrooms

6 bedrooms

6 bedrooms

4 bedrooms

4 bedrooms

4 bedrooms

4 bedrooms

4 bedrooms

4 bedrooms  3 bedrooms

3 bedrooms  4 bedrooms

4 bedrooms  3 bedrooms

3 bedrooms  3 bedrooms

3 bedrooms  3 bedrooms

3 bedrooms  6 bedrooms

6 bedrooms  4 bedrooms

4 bedrooms  4 bedrooms

4 bedrooms  3 bedrooms

3 bedrooms  4 bedrooms

4 bedrooms  4 bedrooms

4 bedrooms  3 bedrooms

3 bedrooms  4 bedrooms

4 bedrooms