|

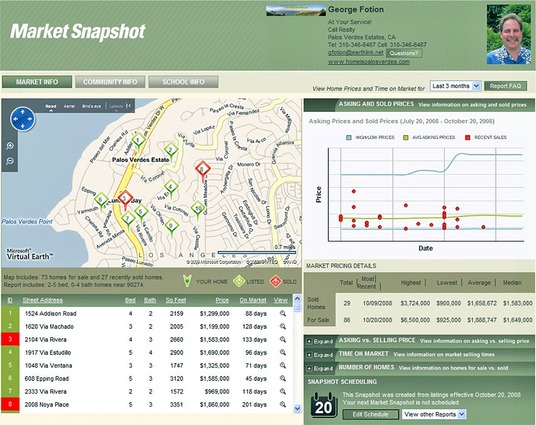

There’s now an additional way to get more trend data on Palos Verdes homes for sale so that if you are buying or selling a home in Palos Verdes, you will be better prepared with information that will maximize your interests. The worst feeling is to not have a roadmap when you’re visiting a strange area. Let my programs be your “GPS” to real estate! Feel welcome to give it a try! Start your search for Homes for Sale in Palos Verdes and start using the Market Trend information today |

||

| originally published at http://realestatemarbles.com/homeispalosverdes/2012/07/26/palos-verdes-real-estate-trends-price-volume-buyer-patterns/ | ||

|

||

Tag Archives: george fotion

Senior Condos in Torrance CA

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

As originally published http://realestatemarbles.com/homeispalosverdes/2012/07/20/over-55-communities-in-torrance-ca/ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||

Palos Verdes Homes Sales Report compared National Real Estate trends

|

WASHINGTON (July 19, 2012) – Existing-home prices continued to show gains but sales fell in June with tight supplies of affordable homes limiting first-time buyers, according to the National Association of Realtors®. Total existing-home sales1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 5.4 percent to a seasonally adjusted annual rate of 4.37 million in June from an upwardly revised 4.62 million in May, but are 4.5 percent higher than the 4.18 million-unit level in June 2011. Lawrence Yun, NAR chief economist, said the bigger story is lower inventory and the recovery in home prices. “Despite the frictions related to obtaining mortgages, buyer interest remains solid. But inventory continues to shrink and that is limiting buying opportunities. This, in turn, is pushing up home prices in many markets,” he said. “The price improvement also results from fewer distressed homes in the sales mix.”

[continue to bottom of screen to see what’s happening in the Palos Verdes homes market] According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage fell to a record low 3.68 percent in June from 3.80 percent in May; the rate was 4.51 percent in June 2011; recordkeeping began in 1971. The national median existing-home price2 for all housing types was $189,400 in June, up 7.9 percent from a year ago. This marks four back-to-back monthly price increases from a year earlier, which last occurred in February to May of 2006. June’s gain was the strongest since February 2006 when the median price rose 8.7 percent from a year prior. Distressed homes3 – foreclosures and short sales sold at deep discounts – accounted for 25 percent of June sales (13 percent were foreclosures and 12 percent were short sales), unchanged from May but down from 30 percent in June 2011. Foreclosures sold for an average discount of 18 percent below market value in June, while short sales were discounted 15 percent. “The distressed portion of the market will further diminish because the number of seriously delinquent mortgages has been falling,” said Yun. NAR President Moe Veissi, broker-owner of Veissi & Associates Inc., in Miami, said there’s been a steady growth in buyer interest. “Buyer traffic has virtually doubled from last fall, while seller traffic has risen only modestly,” he said. “The very favorable market conditions are helping to unleash a pent-up demand, which is why housing supplies have tightened and are supporting growth in home prices. Nonetheless, incorrectly priced homes will not attract buyers.” Total housing inventory at the end June fell another 3.2 percent to 2.39 million existing homes available for sale, which represents a 6.6-month supply4 at the current sales pace, up from a 6.4-month supply in May. Listed inventory is 24.4 percent below a year ago when there was a 9.1-month supply. First-time buyers accounted for 32 percent of purchasers in June, compared with 34 percent in May and 31 percent in June 2011. “A healthy market share of first-time buyers would be about 40 percent, so these figures show that tight inventory in the lower price ranges, along with unnecessarily tight credit standards, are holding back entry level activity,” Yun said. All-cash sales edged up to 29 percent of transactions in June from 28 percent in May; they were 29 percent in June 2011. Investors, who account for the bulk of cash sales, purchased 19 percent of homes in June, up from 17 percent in May; they were 19 percent in June 2011. Single-family home sales declined 5.1 percent to a seasonally adjusted annual rate of 3.90 million in June from 4.11 million in May, but are 4.8 percent above the 3.72 million-unit pace in June 2011. The median existing single-family home price was $190,100 in June, up 8.0 percent from a year ago. Existing condominium and co-op sales fell 7.8 percent to a seasonally adjusted annual rate of 470,000 in June from 510,000 in May, but are 2.2 percent higher than the 460,000-unit level a year ago. The median existing condo price was $183,200 in June, which is 6.9 percent above June 2011. Regionally, existing-home sales in the Northeast dropped 11.5 percent to an annual pace of 540,000 in June but are 1.9 percent above June 2011. The median price in the Northeast was $253,700, down 1.8 percent from a year ago. Existing-home sales in the Midwest slipped 1.9 percent in June to a level of 1.02 million but are 14.6 percent higher than a year ago. The median price in the Midwest was $157,600, up 8.4 percent from June 2011. In the South, existing-home sales declined 4.4 percent to an annual pace of 1.73 million in June but are 5.5 percent above June 2011. The median price in the South was $165,000, up 6.6 percent from a year ago. Existing-home sales in the West fell 6.9 percent to an annual level of 1.08 million in June and are 3.6 percent below a year ago. The median price in the West was $233,300, up 13.3 percent from May 2011. Given tight supply in both the low and middle price ranges in this region, sales in the West are stronger in the higher price ranges. The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries. |

|||||||||||||||||||||||||

| As originally published at http://realestatemarbles.com/homeispalosverdes/2012/07/19/palos-verdes-homes-market-changes-vs-national-real-estate/ | |||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Home selling for top dollar in Palos Verdes

|

How to market homes in Palos Verdes for top dollar It’s really easy. Here are the steps:

See, it’s easy! In all seriousness, executing and implementing these steps is where the difficulty lies. As the old saying goes, “…the devil is in the details…” Let’s take a look at step 1, “make sure the world knows…” Did you know that over 80% (and in some markets it’s nearly 100%) of all buyers go to the internet to search for homes for sale in Palos Verdes? Here are just a couple of the dozens of internet strategies I use to market my clients’ homes… In just the last week, on Realtor.com, my clients’ homes 626 listing views! Just in one week!

and on Facebook, as silly as many people think that media is, one of my pages received 148 new “Likes” in the last week. I read a study a few months ago that indicated that the “average” person has 96 friends on facebook, so with 148 new “Likes” in the last week, this property was seen by an average of 148 x 96 = 14,208 people.

Marketing is not that difficult … it all comes down to “More buyers = More Competition & Demand for the product = Faster sale at a higher price” So, if you are thinking about selling or know someone thinking about selling, or who has had a bad experience in getting their home sold, maybe there are some marketing tactics that you need to learn more about – there are dozens more that I implement to get the job done for my clients. |

|||||||||||||||||||||||||

| This article was originally posted at http://realestatemarbles.com/homeispalosverdes/2012/07/18/selling-a-home-in-palos-verdes-for-top-dollar/ | |||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Ocean View Real Estate in Rancho Palos Verdes

Rancho Palos Verdes Ocean View Homes

View the Virtual Tour With Google Maps, Property, Community & School Information and more. Many people also find this information valuable: George Fotion, Call Realty Company, 424-226-2147 Spectacular Ocean View and Peaceful Private Tranquility … These are the qualities that thunderously make themselves immediately apparent the moment you drive up to this home at 26 Coveview in Rancho Palos Verdes CA. The views rip your breath away and the privacy wraps you in warmth and peacefulness. The one level floor plan makes this an easy home to live in with spacious rooms from the large living room, to the double family room. And dont forget the party deck! Its expanse cant be described in words; take a look at the aerial photo to really grasp the fun you will have here with friends and family! With about a ½ acre of land at your disposal, the pool provides welcome fun without taking anything away from the vast yard spaces. Come see 26 Coveview today! For more information on living in Rancho Palos Verdes please play this brief video:

DRE 785373

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

as originally published at http://realestatemarbles.com/homeispalosverdes/2012/07/07/ocean-view-homes-in-rancho-palos-verdes-ca-3/ |

|||||||||||||||||||||||||

3.8% ObamaTax for Palos Verdes Real Estate?

|

There are a bunch of emails floating around out there that included within the new ObamaTax-icare System is a 3.8% tax on the sale price of your home. While we can disagree on the merits of ObamaCare (I for one am strongly against it) we must get the facts right. It is not true that there is a 3.8% tax on the sale price of your home … HERE ARE THE FACTS … Origins: One of the provisions in the reconciliation bill (HR 4872) passed in conjunction with the Patient Protection Affordable Care Act (PPACA) health care legislation calls for high-income households to be subject to a new 3.8% Medicare tax on investment income starting in 2013: The PPACA creates a new Code Section 1411, which will generally impose a 3.8 percent tax on the lesser of “net investment income” or the excess of modified adjusted gross income over a “threshold amount” (generally, $250,000 for taxpayers filing a joint return, $125,000 for married taxpayers filing a separate return and $200,000 in all other cases). Net investment income generally means the excess of (i) interest, dividends, annuities, royalties, rents, income from passive activities, income from trading financial instruments and commodities, and gain from the disposition of certain non-business property, over (ii) allowable deductions properly allocable to such income. In determining the amount of net investment income, special rules apply with respect to dispositions of equity interests in certain partnerships and S corporations, and to distributions from certain qualified plans. This additional tax applies to taxable years beginning after December 31, 2012. This is a complicated section of a complicated piece of legislation, and the 3.8% Medicare tax has been frequently misreported as amounting to a 3.8% “sales tax” on all real estate transactions. This is incorrect: the Medicare tax is not a sales tax, nor does it apply to all real estate transactions; it is a tax on investment income (income which may or not derive from the sale of property) only for persons who earn more than the amounts specified in the bill.

In his recent guest column regarding the impact of the health care bill, Paul Guppy of the Washington Policy Center claimed that a 3.8 percent tax on all home sales was a part of the recently passed legislation. This is inaccurate and needs to be corrected. The truth about the bill is that if you sell your home for a profit above the capital gains threshold of $250,000 per individual or $500,000 per couple then you would be required to pay the additional 3.8 percent tax on any gain realized over this threshold. Most people who sell their homes will not be impacted by these new regulations. This is not a new tax on every seller, and that correction needs to be made. This tax is aimed at so-called “high earners” — if you do not fall into that category you will not pay any extra taxes upon the sale of your home.

a) The amount by which the couple’s taxable income now exceeds the $250,000 income threshold level. b) The amount of taxable income gained from the sale of their home. In case (b), the dollar figure would be amount of taxable income gained from the sale of their home, which, as detailed above, was $50,000 (i.e., $550,000 profit minus the $500,000 exclusion). The second dollar amount is the lesser of the two, and therefore the couple would have to pay an additional tax of 3.8 percent of $50,000, which would amount to $1,900. (If the hypothetical couple had realized less than a $500,000 profit on the sale of their residence, none of that gain would be subject to the 3.8% tax.) The referenced tax is therefore not a tax on all real estate sales; it is an investment income tax which could result in a very small percentage of home sellers paying additional taxes on home sales profits over a designated threshold amount. In short, if you’re a “high earner” and you sell your home at a substantial profit, you might be required to pay an additional 3.8% tax. However, given that only about 3% of U.S. households have incomes that exceed the specified income threshold amount, the existing home sale capital gains exclusion on a principal residence ($250,000 for individuals, $500,000 for couples) still stands, and the national median existing-home price in January 2012 was only $154,700 , the Medicare tax will likely affect only a very small percentage of home sellers when it is implemented in 2013.

The 3.8% Tax: Real Estate Scenarios & Examples (National Association of Realtors) So whether you are going to have a tax liability or not, and please do consult with your accountant to verify all the information above, the fact remains, what’s the single best way to get the highest price for the sale of your home? The answer is simple – “Marketing 101” as they say, and that’s to have the greatest number of buyers competing for your home. But, that begs the next question, right? “How do I do that?!” It’s all about the internet folks. Take this example on how I was able to get a record breaking price in a down market for a Palos Verdes home |

|||||||||||||||||||||||||

| This article was originally posted here: http://realestatemarbles.com/homeispalosverdes/2012/07/06/palos-verdes-estates-real-estate-question-3-8-obamatax/ | |||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Rancho Palos Verdes Homes for Sale in Portuguese Bend

Portuguese Bend HomesDo you remember the move “Field of Dreams” Where Shoeless Joe Jackson asks Ray Kinsella, “Is this Heaven?” and Ray responds, “No, this And how about homes for sale in Portuguese Bend? Below you will see a couple of free tools you can use (it updates real time so every time you come to the link, it will give you up to minute information – by the way, if you want me to create this tool for other Palos Verdes homes areas, just let me know and I will be happy to perform this customer service for you) to locate and get information on homes for sale in Portuguese Bend. But before you scroll down, consider this home for sale at 72 Narcissa Drive! Free Tools to Search for Rancho Palos Verdes homes To enhance my customer service for you, here are the closed sales of homes in Portuguese Bend |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

As originally posted in http://realestatemarbles.com/homeispalosverdes/2012/07/06/rancho-palos-verdes-homes-in-portuguese-bend/

As originally posted in http://realestatemarbles.com/homeispalosverdes/2012/07/06/rancho-palos-verdes-homes-in-portuguese-bend/

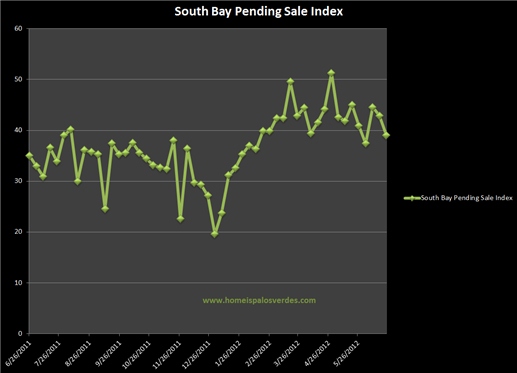

South Bay Pending Sales compared to the West Region of the US

Palos Verdes Real Estate Trends vs the National Housing MarketIt was reported in one of the online trade journals I subscribe to that pending home sales (this is an indicator of “now” activity and measures how buyers “now” are voting with their dollars) have increased yet again. What I would ask that you do is read the article below and then continue on for a more localized report. How are Palos Verdes homes and real estate around the Greater South Bay area faring in relation to these trends? Let’s find out… at the bottom of this article you will see a chart for the South Bay. National Association of Realtors reports Pending Home Sales Up in May, Continue Pattern of Strong Annual Gains Daily Real Estate News | Wednesday, June 27, 2012 Pending home sales bounced back in May, matching the highest level in the past two years, and are well above year-ago levels, according to the National Association of REALTORS®. Both monthly and annual gains were seen in every region.

For more information on real estate trends for the Palos Verdes homes market please go here.

|

|||||||||||||||||||||||||

| originally posted at http://realestatemarbles.com/homeispalosverdes/2012/06/27/south-bay-home…tern-us-region | |||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Real Estate market keeping pace with National Trends?

Will the Palos Verdes Real Estate Market follow National Trends?You may hear the video near the bottom of this post, start to play immediately. To stop it, just scroll down and click the pause key. You can return to it later after reading this post. In the trade journal, “Realty Mag”, there was an article in which 5 projections were made as to where the housing market is headed. Real estate markets across the country are inching their way to a slow recovery after bottoming out, according to several real estate economists who spoke at a forum hosted by the National Association of Real Estate Editors. National Association of REALTORS®’ Chief Economist Lawrence Yun, Zillow Chief Economist Stan Humphries, and National Association of Home Builders Chief Economist David Crowe shared their views on the direction of the housing market during the forum. “Last year was the worst year on record for [new] house sales, for 60 years of housing-sale info,” Crowe said. But things are picking up, the economists note, despite several challenges still threatening that recovery. Yun says that appraisal issues are holding back up to 20 percent of home sales and that lenders’ tightened mortgage underwriting standards are likely holding back another 15 to 20 percent of potential home deals. Here are some of the economists’ forecasts: 1. New-home market: The NAHB predicts a 19 percent increase in single-family housing starts this year over last (from 434,000 last year to a projected 516,000 this year). 2. Single-family rental market: This could be the next housing market bubble, Humphries warns. He expects this sector to cool as rental rates continue to increase and as home ownership looks more attractive to the public again. 3. Distressed home sales: The percentage of distressed homes sales is projected to drop by 25 percent in 2012 and 15 percent in 2013, Yun says. 4. Home price appreciation: Yun says it’s possible some markets may see a 10 percent rise in home-price appreciation next year due to an increase in demand, or a 60 to 70 percent increase in housing starts. Yun argues it won’t be both, however, but rather one or the other. He notes it greatly depends on whether lawmakers reach an agreement once again on the looming debt-ceiling deadline. 5. Home owners’ negative equity: About a third of home owners are underwater, owing more on their mortgage than their home is currently worth. As such, the housing recovery will likely be “stair stepped,” Humphries says. He says home owners with negative equity will gradually begin to list their homes as they see prices inch up, but when they do, that may temporarily swell the housing supply and cause a brief pause to the recovery. There was further discussion in that article about a study done by the Harvard Joint Center for Housing Studies that showed some interesting trends going on right now. I wondered if we would see the same pattern for the Palos Verdes homes market Beginning in mid-2008, mortgage payments were cheaper than rents

As of today, the median sale price of a home sold on the Palos Verdes Peninsula in the last 3 months is $1,200,000. With 25% down payment, and today’s interest rates for a 30 year fixed rate loan being about 4.275%, your monthly PITI (principle, interest, taxes and insurance would be around $5,791/mo. The median rent paid for a Palos Verdes home in the last 3 months is $4,147/mo. Palos Verdes is not following the national trends in this regard. For more information from my “newsroom” play this video

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Latest Palos Verdes Real Estate Trends

|

As you can see by the graph here, my proprietary supply/demand chart predicted the real estate slow down by about 18 months. What’s the chart telling us now? Click on the chart to view a larger picture by signing up for my proprietary charts. If you fill out this brief “sign in” page with your information (this will remain private, I promise you, your information will not be sold, shared or distributed to anyone!), you will receive the link to these pivotal charts and key information to study at your leisure. The information is proprietary and is intended for your use only. Making copies or redistributing the link to others is expressly forbidden without prior permission. The information is intended ONLY for existing and potential clients; not for other real estate professionals (except as a fee based service) Thank you for understanding. Please provide a VALID email address to which I can email you the link for the charts. Thank you. This does NOT result in an automated responder, but rather a live email from me personally. Therefore, again, a VALID email address is required. This information is intended ONLY for existing clients or those considering becoming a client. Thus, all the information below must be completed correctly. Rest assured, I hate spam as much as or more than you, so I promise NEVER to share your information with anyone. Once verified, I look forward to sharing with you the link to my proprietary charts.

For more information on homes for sale in Palos Verdes, Palos Verdes real estate, palos verdes homes for sale, palos verdes foreclosures, palos verdes real estate market information as well as quality information on homes for sale in Rancho Palos Verdes, Palos Verdes Estates homes for sale, Manhattan Beach real estate, Hermosa Beach real estate, Redondo Beach real estate, Torrance real estate, Palos Verdes real estate trends, and real estate trends throughout the Beach Cities, Palos Verdes Estates and the South Bay, visit www.homeispalosverdes.com

DRE LIC # 785373

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

is Iowa”. You will have exactly that same feeling when entering the Portuguese Bend gated community here in Rancho

is Iowa”. You will have exactly that same feeling when entering the Portuguese Bend gated community here in Rancho

Real estate is no different than any other commodity; whether we’re talking about gold, silver, lumber or pork belly futures. Real estate is yet another commodity ruled by the economic laws of supply and demand.

Real estate is no different than any other commodity; whether we’re talking about gold, silver, lumber or pork belly futures. Real estate is yet another commodity ruled by the economic laws of supply and demand.