|

Even if you’ve been around the South Bay a long time like I have (1968 as a 12 year old …. ok, fine … do the math) you realize there’s still a lot to learn about the South Bay. I would like to introduce you to Jackie … she has a wonderful blog that is full of South Bay events. It’s a fun read and I promise you, you will come away from her site saying, “…hmm, I didn’t know that!…” I received this email from Jackie today and thought I would share it with y’all … why not give her blog a try. I think you will like it. I especially liked her comments on the PVLC… who knows, maybe I will see you out on the trails! Then when you’re done reading her blog, you also might find yourself wishing, “…Hmmm, I wish lived over in the _______ area instead of where I do now…” When THAT thought happens, you know what to do. Follow the link in the yellow tab at the bottom of this article … ENJOY!

So what are you doing this weekend? I’m looking forward to playing in the Hermosa Beach Firefighters Poker Tournament this Saturday night. I was knocked out of the competition by a four-of-a-kind hand at last year’s event and I really need to redeem myself! Wish me luck!

As always, check the calendar links and ‘Things to Do’ page on my website, www.southbaybyjackie.com, for details on these and other events throughout the South Bay. On The South Bay Show this morning, we spoke with local hotel and restaurant impresario Michael Zislis He told us all about Rocktoberfest, his joint venture with Gene Simmons and Wolfgang Puck, which takes place all next week at LA LIVE. Don’t worry – if you missed it, you can listen to it here: http://southbaybyjackie.com/october-11-2012-mike-zislis-the-zislis-group-gene-simmons-kiss/. The South Bay Show presents Preparing for Disaster in the South Bay. This very instructive program airs every Friday morning on Blog Talk Radio at 7:00 a.m. Our guest tomorrow morning is Diana Feinberg, Chair of the Beach Cities Joint CERT Organizations Great ShakeOut Drill which takes place in Palos Verdes this year. It will be an interesting and informative hour so tune in! You can listen to it live or at your leisure here: http://southbaybyjackie.com/october-12-2012-diana-feinberg-chair-bcjcos-great-shakeout-drill/. Have a great South Bay weekend! Jackie |

||

| George Fotion, HomeIsPalosVerdes.com | ||

|

||

Tag Archives: homeispalosverdes

5 Ways To Love Your Palos Verdes Home Again

|

Five ways to love your home again If you’ve fallen out of love with your home, and you’re committed to staying put for years to come, it is a worthwhile endeavor to rekindle that romance, and re-excite the spark that makes coming home, being home, maintaining home, and even writing out the checks that keep the lights on, the mortgage paid and the taxes current, a blessing. Here’s how: 1. Spend time in someone else’s home. Make more of an effort than you might otherwise to accept your pals’ barbecue and dinner party invites. Go on those home and garden tours that are put on locally. When you travel, consider renting someone else’s home (or part of it) on a site like Airbnb.com or VRBO.com, rather than just getting a hotel room. And pay attention to the homes’ locations, comfort level, amenities, decor and nice touches, or lack thereof. Most likely, one of two things will happen: If you love their space, you’ll leave inspired to make tweaks to yours; if you don’t love it, you’ll be super-grateful for your home, just as it is. 2. Get out of your comfort zone and routine. Following the theme of inspiration and gratitude, seek out experiences entirely outside of your comfort zone. The further outside your comfort zone the better. Take a trip to a destination unlike the places you normally vacation; if you live in the city, go stay on a working farm. And if you don’t have time to take a whole trip, just spend a couple of hours in a part of town that you don’t normally go to, or spend an afternoon doing something you’ve never done before: Take a workshop, go for a hike or take a tour. If you drive, take the bus. If you’re always checking your phone, lock it in the trunk of your car for a whole weekend. If you eat out, cook — and vice versa. When you have experiences that jolt you completely out of your sense of the norm, it resets your brain in a way that allows you to come home and see things that are familiar in a very different light. 3. Inventory and fix any little glitches. It’s easy to get caught up in the day-to-day duties of living and working and raising a family. As time goes on and little things at home break or need repair, many of us fall into the habit of putting them on a list that never gets done. Over time, as the list of doors that creak and handles you have to jiggle grows longer and longer, that can create doldrums and annoyance, as you have to deal with these little glitches on a daily basis and it starts to feel like “broken” is the normal state of affairs at home. Try taking meticulous care to log and have fixed any and everything that isn’t working exactly as it should. It’s a never-ending battle, mind you; if you keep on living in a home, things will continue to wear out or break, so have a handyman on call to constantly tend to the ongoing list. And every time something is fixed, you’ll be reminded of just how much you love your home. 4. Have a Financial Health Day. Many times, financial hemorrhages and simply feeling like your home is disproportionately draining your bank account can create resentment and anxiety that gets in the way of feeling warm and fuzzy about owning it. Now, every mortgage or home-related financial problem might not be within your power to fix, but rather than letting things spiral without doing anything, the next time you take a personal day off from work, set aside some time to do a deep dive into your home-related financials. Set an appointment with your mortgage broker to discuss refinancing, if appropriate. Appeal your home’s property tax assessment, if you believe it’s too high. Check to see if recent increases in your home’s value will qualify you to have the private mortgage insurance removed from your mortgage. Figure out what side business or job you can do to pay down your consumer debt or help get you out of the stresses of paycheck-to-paycheck living.

6. This one is from me … When you own a Palos Verdes home, realize you live in one of the most beautiful places in the world … a place where people come to vacation! The people who built Trump National and Terranea aren’t stupid!

|

||

| originally published here: George Fotion, HomeIsPalosVerdes.com | ||

|

||

Palos Verdes Home Sales Falling Through – WHY? & What to do!

Why Are More Buyers Canceling Contracts?

RealtorMag reported this week that a high number of buyers are walking away from purchase contracts. Their article was based on the research done by Capital Economics, an independent research firm. They found that nearly 18% of all signed contracts were canceled So what does that mean for the buyer looking to purchase Palos Verdes real estate or the homeowners looking to sell their Palos Verdes homes? When digging into the reasons why, two main categories became apparent. One is psychological and the other is financial. Let’s study the psychological reason first. There’s a balance of power that shifts during negotiations between buyer and seller and when the home is actually in escrow. In a market such as we are now that is grossly undersupplied (refer back to my blog post of a few days ago for Palos Verdes homes supply), in most cases buyers are competing against other buyers for well priced homes. Often, multiple offers result. The balance of power is with the seller in this case and Capital

The second category is financial. “Tight lending requirements are also contributing to contract cancellations, says Paul Diggle, property economist at Capital Economics. As more buyers move off the sidelines to purchase a home, they’re finding they can’t qualify for a mortgage, he says.” And what’s worse folks is that the underwriting criteria are changing all the time, often during the course of an escrow. Nothing is static, everything is fluid. There’s a mortgage banker that I’ve counted on for over 20 years, Kent Kirkpatrick at American Capital (he’s one of the partners in that firm) who is one of the elite best in getting the job done for my buyers. When you’re selling your home in Palos Verdes or anywhere around the South Bay, you need to make sure your agent is properly interrogating the buyer’s agent and the buyer’s mortgage banker on the financial bona fides of the buyer. As a buyer of real estate in Palos Verdes or around the South Bay, you need to understand that the mortgage banker you choose can make the difference between a deal’s life and death. These folks are definitely not all the same. What are some of the things you can do and complete upfront before making an offer as a buyer to make sure your loan goes through and as a seller, what do you need to find out about your buyer.

*How limited are listings in the South Bay? Study this chart and you will see we haven’t seen this low a level of new listing volume in nearly 20 years. What is this doing to prices? What does this mean for your own neighborhood and home? Send me an email or give me call and we can talk about it. Follow the link in the orange tab below to get access to real estate charts such as these. Charts are updated weekly and monthly.

**I hear about these so called “tight lending requirements” and how they are “holding back the purchase market”…. and I am honestly amazed…. Really, tight? A borrower can buy a $750,000 house with 3.5% down and a credit score of 620… can get a 3.25% 30 year fixed rate on that…. 3.25% 30 year fixed rate with a tiny down payment, debt to income ratios of 50%… and a questionable credit history to boot…. “TIGHT?” seriously…. No… it is not… it is still probably a bit loose…. If the government were not backing those FHA loans they would not be out there… no bank would put that program out… not one….

Another example that comes up when I ask why they think lending is tight is that their client was just declined for a loan by a bank. Once we delve into why, the normal problems fall into two categories…. First, the loan officer made the critical mistake of not doing the upfront interview with the client properly…. This is THE most important part of lending… period. The first five minute conversation with the borrower should be the loan officer asking a myriad of questions from “tell me about what you are trying to accomplish with this purchase or this refinance” to then asking detailed, and I mean VERY detailed, questions regarding the borrowers personal finances…. If this is done properly, it will eliminate 99% of any problems that can come up in the approval/funding process. This then takes us to the next most important part, which as I write this, I am wondering if I should have made this the number one part…. Choosing the right lender to do your loan…. this is critical as well…. ( and I will disclose who I am…. I own a 19 year old mortgage bank that survived the last ten years after struggling by not doing subprime loans ( which made no credit sense ) that all other mortgage banks did and then watching most normal financing disappear for three years in the resulting financial meltdown)…. it is my belief that most borrowers, wrongly influenced by the media and the government, believe it is in their best interest to go directly to a bank for a home loan. This could not be farther from the truth. Banks have one set of products, guidelines and goals…. They take only the types of loans and borrowers that fit their needs…. Mortgage bankers have multiple funding options and goals…. The most important goal is to match a borrowers needs to a funding source and do it in an efficient, compliant, honest and straightforward manner. Mortgage bankers have better pricing, better operational efficiency and a much larger product diversity to deliver a wider range of options to the client. While one bank says it will only do loans to 90% loan to value, another might allow 95%… if the borrower apply’ s at the first bank, they may never know that they had an option at 95%…. they may just walk away and say “lending these days is just too tight”…. There are thousands, yes, thousands of examples that are similar to this first one…. the other day a client was referred to me after getting turned down at Wells Fargo… the issue was the debt to income ratio for the borrower was over 41%… industry standard is 45%… we can even go up to 50% with compensating factors like good credit, strong job stability etc… but Wells Fargo has so much business that they have decided they only want the BEST loans… with lower debt ratios… this client had perfect credit, 22 years as a teacher, 15 years as a police officer ( husband) and great cash reserves while putting down 10% on the home… we funded that loan in 9 days at a 3.375% no point 30 year fixed rate. The third most important part…. LISTEN TO YOUR REAL ESTATE AGENT REGARDING THEIR MORTGAGE REFFERAL…. They know… they do this all day, year, career long…. They are not going to refer you to someone who they don’t trust…. They refer you to who gets the best combination of product, price and service…. Period… Fourth most important…. Once you have chosen a lender… trust them… trust that your upfront research and conversations have led you to a funding source that is the right one… and then listen to them and let them lead you through the process. Fifth, expect that numerous times during the process you are going to say “seriously?, you really need that as well?… I have given you so much already and you just keep asking for more?” this is the way it is today… to get these great rates, they put you through the ringer and back… every I dotted, every T crossed… and then they want more…. There is so much that goes into mortgage lending… so much is changing… it is the mortgage professionals job to set the right expectation with the client and make sure to follow through on that…. that is what I do. Kent C. Kirkpatrick, Principal |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Homes on RealEstate.com TV Ad

Exclusive agent for

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Homes or Palos Verdes Condo?

Palos Verdes Homes or Palos Verdes Condo/Townhomes?

You can click on the chart below to view a larger image The old saying in real estate is that for the same price you usually are better off buying the Single Family Residence than the Townhome in the same area. Sure, the SFR may not be as nice of condition and need work or perhaps it’s older, BUT … you can clearly see that when the market was rough, condos and townhomes fell by a greater percentage than did the single family residences. And, as the market recovers, what type of property is appreciating at a faster rate? Yet, I do understand that there are still strong compelling reasons why folks opt for the townhome or the condo. For example, sometimes there aren’t any homes available at the lower price point offered by the condo in the same location and you, for example, really want to be in the Palos Verdes school system. That’s a perfectly understandable and valid reason. All I’m saying is that if you can, stretch to get that Single Family Residence. Your protecting your dollars better and giving them a better chance to grow! As originally published here: George Fotion, HomeIsPalosVerdes.com |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Rancho Palos Verdes Homes – Pending Sale Report

|

Pending Home Sales Slip in June, Remain Above a Year Ago The Pending Home Sales Index,* a forward-looking indicator based on contract signings, slipped 1.4 percent to 99.3 in June from a downwardly revised 100.7 in May but is 9.5 percent higher than June 2011 when it was 90.7. The data reflect contracts but not closings. Lawrence Yun, NAR chief economist, said inventory shortages are a factor. “Buyer interest remains strong but fewer home listings mean fewer contract signing opportunities,” Yun said. “We’ve been seeing a steady decline in the level of housing inventory, which is most pronounced in the lower price ranges popular with first-time buyers and investors.” Here’s the data for the Nation:

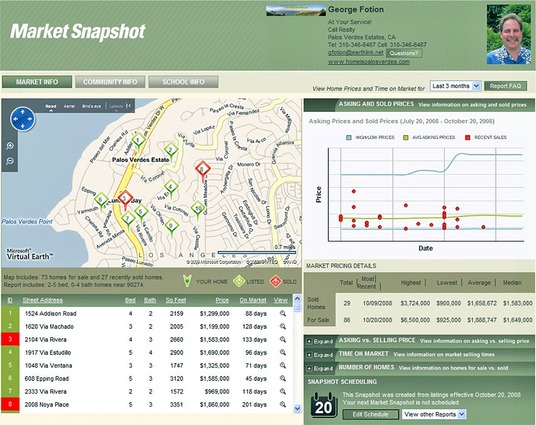

And looking at the Local South Bay Real Estate Market

and how about for Homes in Palos Verdes Estates

To obtain specialized Palos Verdes Estate real estate trend data as well as real estate trends for all Palos Verdes Homes including real estate in Rancho Palos Verdes and Rolling Hills Estates homes for sale and Rolling Hills property, follow the link in the yellow tab below. Here’s a quick video on the type of information you will find which also includes an interactive map based search product to find homes for sale in Palos Verdes

|

|||||||||||||||||||||||||

| as originally published at http://realestatemarbles.com/homeispalosverdes/2012/07/27/home-sale-trends-in-palos-verdes-estates/ | |||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Homes Sales Report compared National Real Estate trends

|

WASHINGTON (July 19, 2012) – Existing-home prices continued to show gains but sales fell in June with tight supplies of affordable homes limiting first-time buyers, according to the National Association of Realtors®. Total existing-home sales1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, declined 5.4 percent to a seasonally adjusted annual rate of 4.37 million in June from an upwardly revised 4.62 million in May, but are 4.5 percent higher than the 4.18 million-unit level in June 2011. Lawrence Yun, NAR chief economist, said the bigger story is lower inventory and the recovery in home prices. “Despite the frictions related to obtaining mortgages, buyer interest remains solid. But inventory continues to shrink and that is limiting buying opportunities. This, in turn, is pushing up home prices in many markets,” he said. “The price improvement also results from fewer distressed homes in the sales mix.”

[continue to bottom of screen to see what’s happening in the Palos Verdes homes market] According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage fell to a record low 3.68 percent in June from 3.80 percent in May; the rate was 4.51 percent in June 2011; recordkeeping began in 1971. The national median existing-home price2 for all housing types was $189,400 in June, up 7.9 percent from a year ago. This marks four back-to-back monthly price increases from a year earlier, which last occurred in February to May of 2006. June’s gain was the strongest since February 2006 when the median price rose 8.7 percent from a year prior. Distressed homes3 – foreclosures and short sales sold at deep discounts – accounted for 25 percent of June sales (13 percent were foreclosures and 12 percent were short sales), unchanged from May but down from 30 percent in June 2011. Foreclosures sold for an average discount of 18 percent below market value in June, while short sales were discounted 15 percent. “The distressed portion of the market will further diminish because the number of seriously delinquent mortgages has been falling,” said Yun. NAR President Moe Veissi, broker-owner of Veissi & Associates Inc., in Miami, said there’s been a steady growth in buyer interest. “Buyer traffic has virtually doubled from last fall, while seller traffic has risen only modestly,” he said. “The very favorable market conditions are helping to unleash a pent-up demand, which is why housing supplies have tightened and are supporting growth in home prices. Nonetheless, incorrectly priced homes will not attract buyers.” Total housing inventory at the end June fell another 3.2 percent to 2.39 million existing homes available for sale, which represents a 6.6-month supply4 at the current sales pace, up from a 6.4-month supply in May. Listed inventory is 24.4 percent below a year ago when there was a 9.1-month supply. First-time buyers accounted for 32 percent of purchasers in June, compared with 34 percent in May and 31 percent in June 2011. “A healthy market share of first-time buyers would be about 40 percent, so these figures show that tight inventory in the lower price ranges, along with unnecessarily tight credit standards, are holding back entry level activity,” Yun said. All-cash sales edged up to 29 percent of transactions in June from 28 percent in May; they were 29 percent in June 2011. Investors, who account for the bulk of cash sales, purchased 19 percent of homes in June, up from 17 percent in May; they were 19 percent in June 2011. Single-family home sales declined 5.1 percent to a seasonally adjusted annual rate of 3.90 million in June from 4.11 million in May, but are 4.8 percent above the 3.72 million-unit pace in June 2011. The median existing single-family home price was $190,100 in June, up 8.0 percent from a year ago. Existing condominium and co-op sales fell 7.8 percent to a seasonally adjusted annual rate of 470,000 in June from 510,000 in May, but are 2.2 percent higher than the 460,000-unit level a year ago. The median existing condo price was $183,200 in June, which is 6.9 percent above June 2011. Regionally, existing-home sales in the Northeast dropped 11.5 percent to an annual pace of 540,000 in June but are 1.9 percent above June 2011. The median price in the Northeast was $253,700, down 1.8 percent from a year ago. Existing-home sales in the Midwest slipped 1.9 percent in June to a level of 1.02 million but are 14.6 percent higher than a year ago. The median price in the Midwest was $157,600, up 8.4 percent from June 2011. In the South, existing-home sales declined 4.4 percent to an annual pace of 1.73 million in June but are 5.5 percent above June 2011. The median price in the South was $165,000, up 6.6 percent from a year ago. Existing-home sales in the West fell 6.9 percent to an annual level of 1.08 million in June and are 3.6 percent below a year ago. The median price in the West was $233,300, up 13.3 percent from May 2011. Given tight supply in both the low and middle price ranges in this region, sales in the West are stronger in the higher price ranges. The National Association of Realtors®, “The Voice for Real Estate,” is America’s largest trade association, representing 1 million members involved in all aspects of the residential and commercial real estate industries. |

|||||||||||||||||||||||||

| As originally published at http://realestatemarbles.com/homeispalosverdes/2012/07/19/palos-verdes-homes-market-changes-vs-national-real-estate/ | |||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

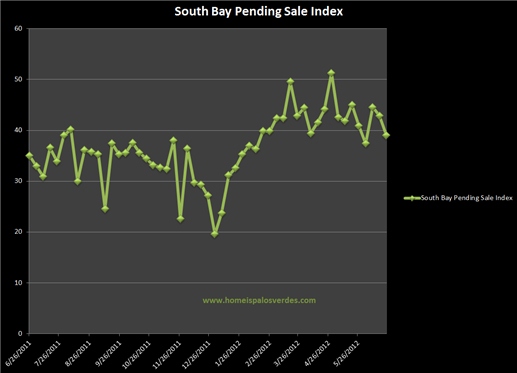

South Bay Pending Sales compared to the West Region of the US

Palos Verdes Real Estate Trends vs the National Housing MarketIt was reported in one of the online trade journals I subscribe to that pending home sales (this is an indicator of “now” activity and measures how buyers “now” are voting with their dollars) have increased yet again. What I would ask that you do is read the article below and then continue on for a more localized report. How are Palos Verdes homes and real estate around the Greater South Bay area faring in relation to these trends? Let’s find out… at the bottom of this article you will see a chart for the South Bay. National Association of Realtors reports Pending Home Sales Up in May, Continue Pattern of Strong Annual Gains Daily Real Estate News | Wednesday, June 27, 2012 Pending home sales bounced back in May, matching the highest level in the past two years, and are well above year-ago levels, according to the National Association of REALTORS®. Both monthly and annual gains were seen in every region.

For more information on real estate trends for the Palos Verdes homes market please go here.

|

|||||||||||||||||||||||||

| originally posted at http://realestatemarbles.com/homeispalosverdes/2012/06/27/south-bay-home…tern-us-region | |||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Real Estate market keeping pace with National Trends?

Will the Palos Verdes Real Estate Market follow National Trends?You may hear the video near the bottom of this post, start to play immediately. To stop it, just scroll down and click the pause key. You can return to it later after reading this post. In the trade journal, “Realty Mag”, there was an article in which 5 projections were made as to where the housing market is headed. Real estate markets across the country are inching their way to a slow recovery after bottoming out, according to several real estate economists who spoke at a forum hosted by the National Association of Real Estate Editors. National Association of REALTORS®’ Chief Economist Lawrence Yun, Zillow Chief Economist Stan Humphries, and National Association of Home Builders Chief Economist David Crowe shared their views on the direction of the housing market during the forum. “Last year was the worst year on record for [new] house sales, for 60 years of housing-sale info,” Crowe said. But things are picking up, the economists note, despite several challenges still threatening that recovery. Yun says that appraisal issues are holding back up to 20 percent of home sales and that lenders’ tightened mortgage underwriting standards are likely holding back another 15 to 20 percent of potential home deals. Here are some of the economists’ forecasts: 1. New-home market: The NAHB predicts a 19 percent increase in single-family housing starts this year over last (from 434,000 last year to a projected 516,000 this year). 2. Single-family rental market: This could be the next housing market bubble, Humphries warns. He expects this sector to cool as rental rates continue to increase and as home ownership looks more attractive to the public again. 3. Distressed home sales: The percentage of distressed homes sales is projected to drop by 25 percent in 2012 and 15 percent in 2013, Yun says. 4. Home price appreciation: Yun says it’s possible some markets may see a 10 percent rise in home-price appreciation next year due to an increase in demand, or a 60 to 70 percent increase in housing starts. Yun argues it won’t be both, however, but rather one or the other. He notes it greatly depends on whether lawmakers reach an agreement once again on the looming debt-ceiling deadline. 5. Home owners’ negative equity: About a third of home owners are underwater, owing more on their mortgage than their home is currently worth. As such, the housing recovery will likely be “stair stepped,” Humphries says. He says home owners with negative equity will gradually begin to list their homes as they see prices inch up, but when they do, that may temporarily swell the housing supply and cause a brief pause to the recovery. There was further discussion in that article about a study done by the Harvard Joint Center for Housing Studies that showed some interesting trends going on right now. I wondered if we would see the same pattern for the Palos Verdes homes market Beginning in mid-2008, mortgage payments were cheaper than rents

As of today, the median sale price of a home sold on the Palos Verdes Peninsula in the last 3 months is $1,200,000. With 25% down payment, and today’s interest rates for a 30 year fixed rate loan being about 4.275%, your monthly PITI (principle, interest, taxes and insurance would be around $5,791/mo. The median rent paid for a Palos Verdes home in the last 3 months is $4,147/mo. Palos Verdes is not following the national trends in this regard. For more information from my “newsroom” play this video

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Latest Palos Verdes Real Estate Trends

|

As you can see by the graph here, my proprietary supply/demand chart predicted the real estate slow down by about 18 months. What’s the chart telling us now? Click on the chart to view a larger picture by signing up for my proprietary charts. If you fill out this brief “sign in” page with your information (this will remain private, I promise you, your information will not be sold, shared or distributed to anyone!), you will receive the link to these pivotal charts and key information to study at your leisure. The information is proprietary and is intended for your use only. Making copies or redistributing the link to others is expressly forbidden without prior permission. The information is intended ONLY for existing and potential clients; not for other real estate professionals (except as a fee based service) Thank you for understanding. Please provide a VALID email address to which I can email you the link for the charts. Thank you. This does NOT result in an automated responder, but rather a live email from me personally. Therefore, again, a VALID email address is required. This information is intended ONLY for existing clients or those considering becoming a client. Thus, all the information below must be completed correctly. Rest assured, I hate spam as much as or more than you, so I promise NEVER to share your information with anyone. Once verified, I look forward to sharing with you the link to my proprietary charts.

For more information on homes for sale in Palos Verdes, Palos Verdes real estate, palos verdes homes for sale, palos verdes foreclosures, palos verdes real estate market information as well as quality information on homes for sale in Rancho Palos Verdes, Palos Verdes Estates homes for sale, Manhattan Beach real estate, Hermosa Beach real estate, Redondo Beach real estate, Torrance real estate, Palos Verdes real estate trends, and real estate trends throughout the Beach Cities, Palos Verdes Estates and the South Bay, visit www.homeispalosverdes.com

DRE LIC # 785373

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

home at the California Science Center. Endeavour will leave LAX on Friday, October 12, for a two day road trip, arriving at the Science Center on Saturday, October 13. If you want to witness this historic and epic passage, you’ll need to figure out when and where to be and how to get there. I’ve listed road closures on my website here:

home at the California Science Center. Endeavour will leave LAX on Friday, October 12, for a two day road trip, arriving at the Science Center on Saturday, October 13. If you want to witness this historic and epic passage, you’ll need to figure out when and where to be and how to get there. I’ve listed road closures on my website here:  through October 21 and can be viewed at two galleries simultaneously. IMAGINE ART will be displayed at 608 North Gallery and IMAGINE NO BOUNDARIES will be shown at Cannery Row Studios. The opening reception will take place at both galleries on Saturday, October 13 from 7 to 10 p.m. The event is open to the public and everyone is invited to stop by, meet the artists and view the works on display. Cannery Row Studios is located at 604 North Francesca and 608 North Gallery is located next door at 608 North Francesca in Redondo Beach. Exhibit hours are Thursday, Friday and Saturday from noon to 7 p.m. and Sunday from noon to 5 p.m. For more information, visit the websites at

through October 21 and can be viewed at two galleries simultaneously. IMAGINE ART will be displayed at 608 North Gallery and IMAGINE NO BOUNDARIES will be shown at Cannery Row Studios. The opening reception will take place at both galleries on Saturday, October 13 from 7 to 10 p.m. The event is open to the public and everyone is invited to stop by, meet the artists and view the works on display. Cannery Row Studios is located at 604 North Francesca and 608 North Gallery is located next door at 608 North Francesca in Redondo Beach. Exhibit hours are Thursday, Friday and Saturday from noon to 7 p.m. and Sunday from noon to 5 p.m. For more information, visit the websites at  Casino Night charity event on Saturday, October 13. The fundraiser takes place at American Junkie Restaurant located at 68 Pier Avenue in Hermosa Beach with the action getting under way at 5:30 p.m. The evening features a silent auction along with hors d’oeuvres, music and a no-host bar. Prizes will be raffled off along with additional prizes for the finalists in the poker tournament. A Casino Night ticket (non-poker player) is $45 per person or two for $85. A seat at the poker table costs $95 and its all tax deductible. For more information and ticket purchase, visit the website at

Casino Night charity event on Saturday, October 13. The fundraiser takes place at American Junkie Restaurant located at 68 Pier Avenue in Hermosa Beach with the action getting under way at 5:30 p.m. The evening features a silent auction along with hors d’oeuvres, music and a no-host bar. Prizes will be raffled off along with additional prizes for the finalists in the poker tournament. A Casino Night ticket (non-poker player) is $45 per person or two for $85. A seat at the poker table costs $95 and its all tax deductible. For more information and ticket purchase, visit the website at

yeast. Celebrate Octoberfest at Terrenea Resort on Saturday, October 13 from 11 a.m. to midnight and Sunday, October 14 from 11 a.m. to 5 p.m. Nelson’s at Terranea celebrates Oktoberfest with a special menu featuring an authentic German spread that includes Munich Sausage Salad, Munich Weiss Wurst, Obazda (a traditional Bavarian cheese spread served with sweet onion rings), Crispy Roasted Pork Shank, Tradition Wiener Schnitzel and Munich-style Sauerbraten. The event will also feature live music on Saturday from 4 to 8 p.m. and Sunday from 1 to 4 p.m. By all means, wear your lederhosen! Terrenea Resort is located at 100 Terranea Way in Rancho

yeast. Celebrate Octoberfest at Terrenea Resort on Saturday, October 13 from 11 a.m. to midnight and Sunday, October 14 from 11 a.m. to 5 p.m. Nelson’s at Terranea celebrates Oktoberfest with a special menu featuring an authentic German spread that includes Munich Sausage Salad, Munich Weiss Wurst, Obazda (a traditional Bavarian cheese spread served with sweet onion rings), Crispy Roasted Pork Shank, Tradition Wiener Schnitzel and Munich-style Sauerbraten. The event will also feature live music on Saturday from 4 to 8 p.m. and Sunday from 1 to 4 p.m. By all means, wear your lederhosen! Terrenea Resort is located at 100 Terranea Way in Rancho  Attendance is free but if you want to sample the fabulous food, tasting tickets are priced at $1 each. Receive one raffle entry to win a prize when you purchase 10 tickets. Each restaurant will feature a different menu item and non-food retailers will offer special discounts. There will be plenty of live music on the stage at the end of the pier over the water as well as free balloons, face painting and arts & crafts at the new SoCal City Kids Zone. The event benefits the Cancer Support Community and the Redondo Beach Educational Foundation. So take a few hours this weekend to stroll the Pier, savor small bites, listen to some live music and maybe spot a few blue whales. The Redondo Beach Pier is located at 100 Fisherman’s Wharf in Redondo Beach. Tickets are available for purchase at the event. For more information, visit the website at

Attendance is free but if you want to sample the fabulous food, tasting tickets are priced at $1 each. Receive one raffle entry to win a prize when you purchase 10 tickets. Each restaurant will feature a different menu item and non-food retailers will offer special discounts. There will be plenty of live music on the stage at the end of the pier over the water as well as free balloons, face painting and arts & crafts at the new SoCal City Kids Zone. The event benefits the Cancer Support Community and the Redondo Beach Educational Foundation. So take a few hours this weekend to stroll the Pier, savor small bites, listen to some live music and maybe spot a few blue whales. The Redondo Beach Pier is located at 100 Fisherman’s Wharf in Redondo Beach. Tickets are available for purchase at the event. For more information, visit the website at  people were registered in ShakeOut drills worldwide. The Great California ShakeOut is an annual opportunity to practice how to be safer and better prepared before, during and after big earthquakes. The ShakeOut has been organized to encourage individuals, families, communities, schools, businesses and organizations to review and update emergency preparedness plans and supplies and to secure structures in order to prevent damage and injuries. It’s time to get ready. To register, visit the website at

people were registered in ShakeOut drills worldwide. The Great California ShakeOut is an annual opportunity to practice how to be safer and better prepared before, during and after big earthquakes. The ShakeOut has been organized to encourage individuals, families, communities, schools, businesses and organizations to review and update emergency preparedness plans and supplies and to secure structures in order to prevent damage and injuries. It’s time to get ready. To register, visit the website at

during the three month period of May, June and July of 2012. The last time that number was so high was back in May of 2010 when the number reached 23% and before the housing slump, the number never exceeded 10%.

during the three month period of May, June and July of 2012. The last time that number was so high was back in May of 2010 when the number reached 23% and before the housing slump, the number never exceeded 10%. Economics stated, “Ironically, the recent pickup in home sales is contributing to rising contract cancellations. As more buyers compete over a limited inventory of for-sale homes*, some are bidding aggressively to get the seller’s attention, but not assessing whether they truly want the house until they’re in contract”. Now that buyer has won the house and they’re in escrow, then the balance of power shifts to the buyer who may in fact have buyer’s remorse or tend to request concessions from the seller based on the results of the home inspection. What are some steps you can take as a seller to help yourself during this natural and organic power shift? These are the three tips I give my sellers of homes in

Economics stated, “Ironically, the recent pickup in home sales is contributing to rising contract cancellations. As more buyers compete over a limited inventory of for-sale homes*, some are bidding aggressively to get the seller’s attention, but not assessing whether they truly want the house until they’re in contract”. Now that buyer has won the house and they’re in escrow, then the balance of power shifts to the buyer who may in fact have buyer’s remorse or tend to request concessions from the seller based on the results of the home inspection. What are some steps you can take as a seller to help yourself during this natural and organic power shift? These are the three tips I give my sellers of homes in

I have asked numerous people in the past two years when I am asked about the tight lending standards of banks today to give me an example…. Most cannot come up with a plausible example of where a borrower should have obtained financing and didn’t….. those that do site a borrower who has a large amount of equity, excellent credit history and great cash reserves but lack a solid or consistent income…. just because you have the first three does not mean you qualify for new debt…. If you rely on equity or existing cash reserves to make payments (on some occasions this can make sense) it does not mean the new loan will be repaid the same as those with solid cash flow from a consistent income… all too often in the past five years we have seen instances where borrowers had the first three and chose to walk away from the new debt rather than liquidate their equity, cash reserves etc….. it does make sense that in the overall picture, a borrower should have the cash flow to pay for a debt…. That is good lending, sound principal… it can also make sense that in a case by case basis a lender who specializes in loans not sold to the large government agencies like fannie mae and freddie mac, to step into this area and make these loans to solid borrowers who don’t fit the norm…. it does not make sense for large government agencies to do these as we have seen from the past…. They should focus on exactly the type of lending they are doing today….

I have asked numerous people in the past two years when I am asked about the tight lending standards of banks today to give me an example…. Most cannot come up with a plausible example of where a borrower should have obtained financing and didn’t….. those that do site a borrower who has a large amount of equity, excellent credit history and great cash reserves but lack a solid or consistent income…. just because you have the first three does not mean you qualify for new debt…. If you rely on equity or existing cash reserves to make payments (on some occasions this can make sense) it does not mean the new loan will be repaid the same as those with solid cash flow from a consistent income… all too often in the past five years we have seen instances where borrowers had the first three and chose to walk away from the new debt rather than liquidate their equity, cash reserves etc….. it does make sense that in the overall picture, a borrower should have the cash flow to pay for a debt…. That is good lending, sound principal… it can also make sense that in a case by case basis a lender who specializes in loans not sold to the large government agencies like fannie mae and freddie mac, to step into this area and make these loans to solid borrowers who don’t fit the norm…. it does not make sense for large government agencies to do these as we have seen from the past…. They should focus on exactly the type of lending they are doing today….

Real estate is no different than any other commodity; whether we’re talking about gold, silver, lumber or pork belly futures. Real estate is yet another commodity ruled by the economic laws of supply and demand.

Real estate is no different than any other commodity; whether we’re talking about gold, silver, lumber or pork belly futures. Real estate is yet another commodity ruled by the economic laws of supply and demand.