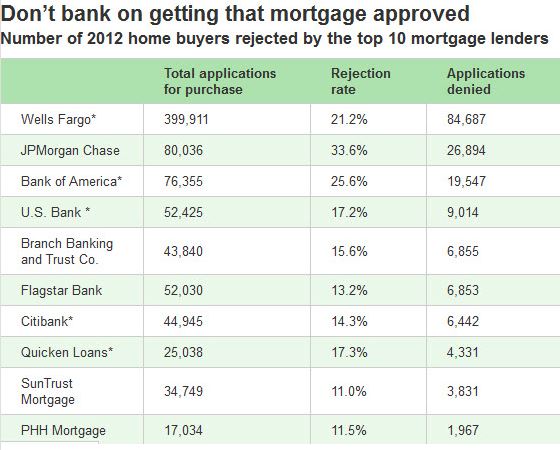

Getting Home Loans Palos Verdes and elsewhere in the South Bay are obviously not guaranteed. What are the chances of your application getting rejected?

Home-buyer rejection rates for major banks range from 11% to 34% according to data released by the Federal Financial Institutions Examination Council.

Even though all banks sell most of their mortgages to Fannie-Freddie-FHA, every bank requires applicants to clear additional hurdles (“overlays”) that far surpass federal guidelines. Overlays are self-imposed guidelines which banks follow when approving a mortgage applicant.

Overlays vary by institution but usually focus on:

1) Credit scores.

2) Debt-to-income ratio requirements.

3) Minimum job history, calculation of bonus and overtime pay.

- A specific example: Freddie Mac has a loan program requiring only a 1 year tax return for approval (20% down) vs. (all) banks have a 2 year requirement.

- Overlays stem from the housing downturn when Fannie/ Freddie forced “buybacks” on banks, loans sold to them just before borrowers defaulted.

- Buybacks can also result when a mortgage application is poorly underwritten by lenders or because of other violations (fraud).

- Buybacks are the lowest level in 4 yrs. according to Inside Mortgage Finance.

- But experts say banks are sticking to their additional requirements to avoid new losses.

“[They’ve made] decisions about whether they want to skate right on the edge of those guidelines or be in a comfort zone,” says Stuart Gabriel, director of the Ziman Center for Real Estate at the University of California, Los Angeles.

As you can see, going to a “direct” lender is like trying to fit a “square peg in a round hole”. Your financial profile as far as home loans Palos Verdes shopping m ay just not fit the lender to whom you’ve applied. So how do you maximize your chances of getting home loans palos verdes maximized for your needs?

ay just not fit the lender to whom you’ve applied. So how do you maximize your chances of getting home loans palos verdes maximized for your needs?

In my opinion, rather than walking into the door of your bank, you should consider using the services of a mortgage banker. Many of the mortgage bankers work with dozens if not hundreds of direct lenders so home loans palos verdes applications are custom fit between your financial profile and the dozens and dozens of loan products that are out there on any given day. Keep mindful of the fact that loan products change all the times. Money sources such as hedge funds or insurance companies will have a block of a hundred million dollars or so that they’ve earmarked for a particular interest rate and terms structure. That product may be aggressively priced making it a good deal for the consumer, but once that block of money is gone, it’s gone. A mortgage banker is expert at finding these sources and matching you up.

Some of the good ones that I’ve worked with are:

Kent Kirkpatrick of American Capital (310) 640-0100

Bob Jones of Doma Mortgage (949) 363-9750

Chris Brown of RPM (714) 969-2300

Craig Barton of CBLoans (310) 266-3958

You are welcome to contact me for more details on my personal experiences with these guys.

Follow me on Google+

and while you’re at it, let’s start a “Hang Out”

Learn about the latest real estate news

Get the latest real estate trends from Manhattan Beach homes south through the Palos Verdes homes markets

Deep demographics on the individual multiple listing service areas, not just zip codes but rather specific zip codes

Original Content for Palos Verdes Homes