|

Pending Home Sales Slip in June, Remain Above a Year Ago The Pending Home Sales Index,* a forward-looking indicator based on contract signings, slipped 1.4 percent to 99.3 in June from a downwardly revised 100.7 in May but is 9.5 percent higher than June 2011 when it was 90.7. The data reflect contracts but not closings. Lawrence Yun, NAR chief economist, said inventory shortages are a factor. “Buyer interest remains strong but fewer home listings mean fewer contract signing opportunities,” Yun said. “We’ve been seeing a steady decline in the level of housing inventory, which is most pronounced in the lower price ranges popular with first-time buyers and investors.” Here’s the data for the Nation:

And looking at the Local South Bay Real Estate Market

and how about for Homes in Palos Verdes Estates

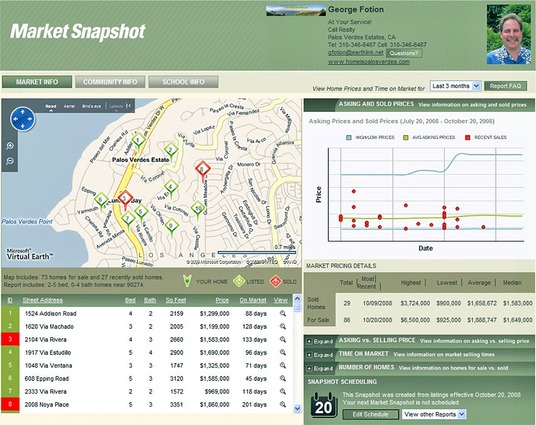

To obtain specialized Palos Verdes Estate real estate trend data as well as real estate trends for all Palos Verdes Homes including real estate in Rancho Palos Verdes and Rolling Hills Estates homes for sale and Rolling Hills property, follow the link in the yellow tab below. Here’s a quick video on the type of information you will find which also includes an interactive map based search product to find homes for sale in Palos Verdes

|

||

| as originally published at http://realestatemarbles.com/homeispalosverdes/2012/07/27/home-sale-trends-in-palos-verdes-estates/ | ||

|

||

Tag Archives: home sale trends in palos verdes

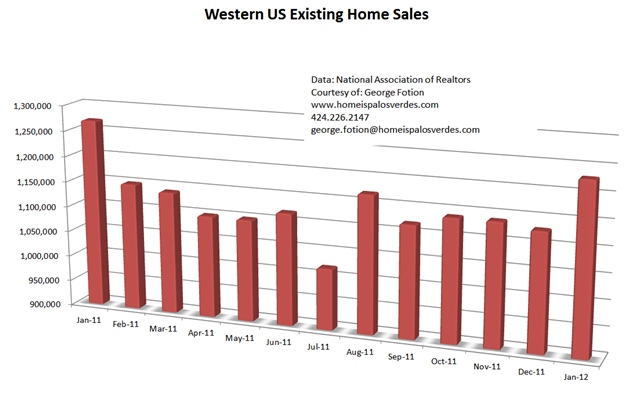

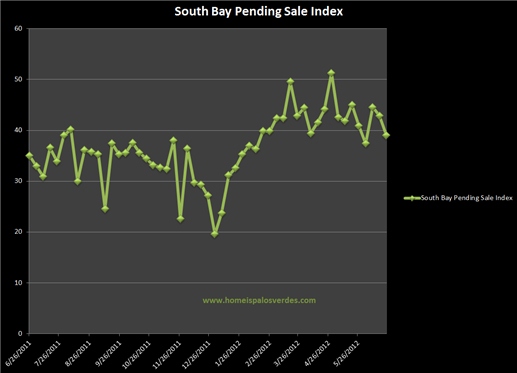

South Bay Pending Sales compared to the West Region of the US

Palos Verdes Real Estate Trends vs the National Housing MarketIt was reported in one of the online trade journals I subscribe to that pending home sales (this is an indicator of “now” activity and measures how buyers “now” are voting with their dollars) have increased yet again. What I would ask that you do is read the article below and then continue on for a more localized report. How are Palos Verdes homes and real estate around the Greater South Bay area faring in relation to these trends? Let’s find out… at the bottom of this article you will see a chart for the South Bay. National Association of Realtors reports Pending Home Sales Up in May, Continue Pattern of Strong Annual Gains Daily Real Estate News | Wednesday, June 27, 2012 Pending home sales bounced back in May, matching the highest level in the past two years, and are well above year-ago levels, according to the National Association of REALTORS®. Both monthly and annual gains were seen in every region.

For more information on real estate trends for the Palos Verdes homes market please go here.

|

||

| originally posted at http://realestatemarbles.com/homeispalosverdes/2012/06/27/south-bay-home…tern-us-region | ||

|

||

Palos Verdes Real Estate market keeping pace with National Trends?

Will the Palos Verdes Real Estate Market follow National Trends?You may hear the video near the bottom of this post, start to play immediately. To stop it, just scroll down and click the pause key. You can return to it later after reading this post. In the trade journal, “Realty Mag”, there was an article in which 5 projections were made as to where the housing market is headed. Real estate markets across the country are inching their way to a slow recovery after bottoming out, according to several real estate economists who spoke at a forum hosted by the National Association of Real Estate Editors. National Association of REALTORS®’ Chief Economist Lawrence Yun, Zillow Chief Economist Stan Humphries, and National Association of Home Builders Chief Economist David Crowe shared their views on the direction of the housing market during the forum. “Last year was the worst year on record for [new] house sales, for 60 years of housing-sale info,” Crowe said. But things are picking up, the economists note, despite several challenges still threatening that recovery. Yun says that appraisal issues are holding back up to 20 percent of home sales and that lenders’ tightened mortgage underwriting standards are likely holding back another 15 to 20 percent of potential home deals. Here are some of the economists’ forecasts: 1. New-home market: The NAHB predicts a 19 percent increase in single-family housing starts this year over last (from 434,000 last year to a projected 516,000 this year). 2. Single-family rental market: This could be the next housing market bubble, Humphries warns. He expects this sector to cool as rental rates continue to increase and as home ownership looks more attractive to the public again. 3. Distressed home sales: The percentage of distressed homes sales is projected to drop by 25 percent in 2012 and 15 percent in 2013, Yun says. 4. Home price appreciation: Yun says it’s possible some markets may see a 10 percent rise in home-price appreciation next year due to an increase in demand, or a 60 to 70 percent increase in housing starts. Yun argues it won’t be both, however, but rather one or the other. He notes it greatly depends on whether lawmakers reach an agreement once again on the looming debt-ceiling deadline. 5. Home owners’ negative equity: About a third of home owners are underwater, owing more on their mortgage than their home is currently worth. As such, the housing recovery will likely be “stair stepped,” Humphries says. He says home owners with negative equity will gradually begin to list their homes as they see prices inch up, but when they do, that may temporarily swell the housing supply and cause a brief pause to the recovery. There was further discussion in that article about a study done by the Harvard Joint Center for Housing Studies that showed some interesting trends going on right now. I wondered if we would see the same pattern for the Palos Verdes homes market Beginning in mid-2008, mortgage payments were cheaper than rents

As of today, the median sale price of a home sold on the Palos Verdes Peninsula in the last 3 months is $1,200,000. With 25% down payment, and today’s interest rates for a 30 year fixed rate loan being about 4.275%, your monthly PITI (principle, interest, taxes and insurance would be around $5,791/mo. The median rent paid for a Palos Verdes home in the last 3 months is $4,147/mo. Palos Verdes is not following the national trends in this regard. For more information from my “newsroom” play this video

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Latest Palos Verdes Real Estate Trends

|

As you can see by the graph here, my proprietary supply/demand chart predicted the real estate slow down by about 18 months. What’s the chart telling us now? Click on the chart to view a larger picture by signing up for my proprietary charts. If you fill out this brief “sign in” page with your information (this will remain private, I promise you, your information will not be sold, shared or distributed to anyone!), you will receive the link to these pivotal charts and key information to study at your leisure. The information is proprietary and is intended for your use only. Making copies or redistributing the link to others is expressly forbidden without prior permission. The information is intended ONLY for existing and potential clients; not for other real estate professionals (except as a fee based service) Thank you for understanding. Please provide a VALID email address to which I can email you the link for the charts. Thank you. This does NOT result in an automated responder, but rather a live email from me personally. Therefore, again, a VALID email address is required. This information is intended ONLY for existing clients or those considering becoming a client. Thus, all the information below must be completed correctly. Rest assured, I hate spam as much as or more than you, so I promise NEVER to share your information with anyone. Once verified, I look forward to sharing with you the link to my proprietary charts.

For more information on homes for sale in Palos Verdes, Palos Verdes real estate, palos verdes homes for sale, palos verdes foreclosures, palos verdes real estate market information as well as quality information on homes for sale in Rancho Palos Verdes, Palos Verdes Estates homes for sale, Manhattan Beach real estate, Hermosa Beach real estate, Redondo Beach real estate, Torrance real estate, Palos Verdes real estate trends, and real estate trends throughout the Beach Cities, Palos Verdes Estates and the South Bay, visit www.homeispalosverdes.com

DRE LIC # 785373

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Real Estate Trends – South Bay sale volume BREAKOUT

Palos Verdes Homes for sale3 Home Search Tools that are FREEI’ve developed 3 search tools that you are welcome to use when searching for Palos Verdes homes for sale or any homes for sale around the South Bay area. Use all three if you wish. Each have their own distinct benefits, so I won’t presume to suggest which one is best for you. Try them all and see which you prefer To start, go to my website at www.homeispalosverdes.com. Play this video for a brief overview on each of the tools. Feel welcome to contact me if you need any help; I can even set up a “Go To Meeting” online private webinar for you if you want to see any or all of these search tools in action. That way, you can become expert at searching through the multiple listing service almost as if you were an agent yourself! While you’re at it, you might be interested in learning about some major changes that are occurring in the real estate market for the South Bay. Don’t assume the market today is like it has been over the last 3 years. Here’s proof based on FACTS as to why I’m making that representation. If you would like to gain access to my proprietary charts AND you are NOT an agent AND you are willing to consider choosing me to represent you on the sale or purchase of real estate here in the South Bay/ Palos Verdes real estate areas, then go to this Palos Verdes Real Estate Transactions and South Bay Trend Charts site |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Is the Palos Verdes real estate market improving? Here’s a hint!

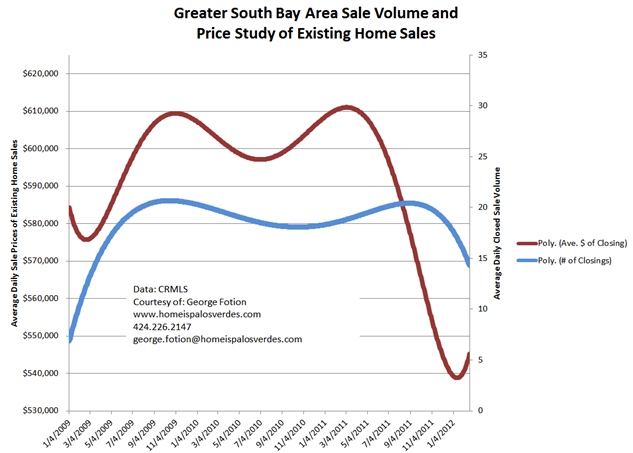

What’s one way to tell the Palos Verdes Homes and South Bay Real Estate market is getting BETTER?Ask any stock broker or commodity broker adept at using technical indicators to “time” trades, and one of the tools they use is to study “VOLUME” changes relating to resistance and support trend lines. Real estate, being a commodity like gold, silver, grain futures etc, can also be “predicted” by studying volume changes. Look at what’s happening with Palos Verdes home sales as a partial component to this chart for the South Bay real estate market… for the first time in THREE YEARS we see resistance broken to the upside. Of course no one has a crystal ball and fortunes have been won and lost trying to time “bottoms” and “tops”, but clearly this is a positive development. For more information on other real estate trends for Palos Verdes real estate and South Bay home trends, follow the link in the yellow tab below.

If you’re reading a blog in which the yellow tab doesn’t appear, just go to my website at www.homeispalosverdes.com scroll down to the section of my website beneath the section that says “More Free Services”. It’s about three quarters of the way down the page.

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Home Price Trend Report May 2012

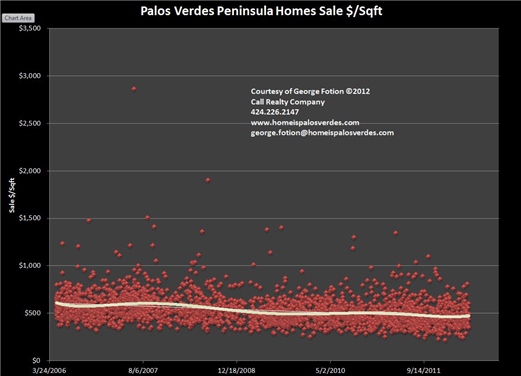

Home prices rise in Half of U.S. Cities as Markets StabilizeThere was an interesting article in Bloomberg today that I read as reported by the National Association of Realtors in which it was represented that home prices rose in half of U.S. cities in the the first quarter of 2012. However as you read further into the article and not just the headline, you see that experts said “The housing market is still depressed but it had a good quarter,” Patrick Newport, an economist at IHS Global Insight in Lexington, Massachusetts, said in a telephone interview today. “We’re on the mend but it’s still something that will take two or three years before we’re back to normal.” To read the full article, follow this link – http://www.bloomberg.com/news/2012-05-09/home-prices-rise-in-half-of-u-s-cities-as-markets-stabilize.html There’s an old saying in real estate; no, not the “location, location, location” saying, but one just as old and it goes like this: “REAL ESTATE IS ALL LOCAL” When it comes down to it, who cares what is happening in Des Moines, Iowa. We really want to know what’s happening HERE, for Palos Verdes homes. Here’s the latest information in chart form; it shows Palos Verdes home sale prices (on a dollar per square foot basis) since the peak of our market in the 3rd/4th quarter of 2006 through today. You are welcome to visit my website for more Palos Verdes real estate trends. |

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Real Estate Trends vs Western US and the “cost” of rising sales

Existing Homes Sales Rise, but at a costExisting-home sales rose in January, marking three gains in the past four months, while inventories continued to improve, according to the National Association of Realtors®. Total existing-home sales1, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 4.3 percent to a seasonally adjusted annual rate of 4.57 million in January from a downwardly revised 4.38 million-unit pace in December and are 0.7 percent above a spike to 4.54 million in January 2011. Lawrence Yun, NAR chief economist, said strong gains in contract activity in recent months show buyers are responding to very favorable market conditions. “The uptrend in home sales is in line with all of the underlying fundamentals – pent-up household formation, record-low mortgage interest rates, bargain home prices, sustained job creation and rising rents.” To read the full story, go here: http://www.realtor.org/press_room/news_releases/2012/02/ehs_jan What the story underplays however is that there was a cost to the rise in home sales and before you conclude I’m just a “Negative Nancy”, there may just be a silver lining to all of this. The cost is clear as evidenced by these charts. Home sales rose because prices have been dropping and as a result of lower prices, demand increased. Economists call this “elasticity of demand” and it appears that the real estate market is highly elastic as small changes in prices caused huge changes in demand. The National Association of Realtors reported that while prices are down in the “West” about 1.8%, home sales rose 8.8% You’ve heard me often say that real estate is all local and you would be right to say “so what” to what’s happening on a national or even regional basis. Keep reading below to see the charts on price and home sale volume for the South Bay. Meanwhile, thank you for reading your latest newsletter and when you come across someone looking to buy or sell real estate here in Palos Verdes or around the South Bay, take out your cell phone and text or call me! At Your Service, George Fotion

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Palos Verdes Estates Pending Home Sale Trends

Palos Verdes Estates Home Pending Sales Shows UptrendThe National Association of Realtors published today their latest study on home sales and there has been a significant improvement. “Existing-home sales continued on an uptrend in December, rising for three consecutive months and remaining above where they were a year ago, according to the National Association of REALTORS®. The latest monthly data shows total existing-home sales rose 5.0 percent to a seasonally adjusted annual rate of 4.61 million in December from a downwardly revised 4.39 million in November, and are 3.6 percent higher than the 4.45 million-unit level in December 2010. The estimates are based on completed transactions from multiple listing services that include single-family homes, townhomes, condominiums and co-ops.” You can read the entire article by going here. But while national trends are interesting … what’s happening on the local level. For example, let’s take a look at Palos Verdes Estates real estate. Are pending sales (these are the Palos Verdes Estates homes that are entering escrow) increasing or decreasing? What’s the general trend? Obviously no matter what asset class we study, nothing goes straight line up or straight line down. So take a careful look at the highs and lows. Are there “higher highs” and “higher lows”? What’s this tell you about what the market’s direction might be in the next few months? You are welcome to request access to other charts I keep for the Palos Verdes real estate market and general South Bay real estate market by visiting this link.

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

|

|||||||||||||||||||||||||

Real estate is no different than any other commodity; whether we’re talking about gold, silver, lumber or pork belly futures. Real estate is yet another commodity ruled by the economic laws of supply and demand.

Real estate is no different than any other commodity; whether we’re talking about gold, silver, lumber or pork belly futures. Real estate is yet another commodity ruled by the economic laws of supply and demand.